In general, I prefer simple investment ideas over more complicated ones. Gulf Island Fabrication (GIFI) fits the bill; the company is currently trading at a 30% discount to its book value and based on recent asset sales I think the company should close that gap in the coming year. While the company's earnings have been poor for multiple years, their last two quarters have been operationally cashflow neutral and recent project commitments have given them a healthy backlog going into 2019. I don't expect GIFI to wow investors with their earnings anytime soon, but if management can show the market that operations have stabilized by the end of 2019, I think the company will trade close to book value and provide an investor with 30% upside.

Company InformationGIFI has three primary sources of revenue: building small-scale marine vessels (think tugboats, ferries, etc) for the US Navy and state governments, fabricating steel structures for offshore drilling and other various marine projects, and providing maintenance and engineering support services for offshore oil platforms. Of the three divisions, only the services division is currently profitable, with the ship building and fabrication divisions both having negative gross margins in 2018. The fabrication division has been hit particularly hard of late, with a slowdown in the offshore drilling market leading to under-utilization of their production facilities and tariffs on imported steel cutting into their margins. Fabrication revenues fell almost 35% in 2018, though this revenue loss was offset by an almost equally-sized improvement in services revenue. The shipyard division grew revenues substantially over the year, with an 83% growth in sales coming primarily from a new project to construct ten harbor tugboats for the US Navy. Despite resulting in a jump in revenue, the tugboat project has been marred by problems with the ships' piping systems, leading to increased production costs and forcing the company's CEO to admit on the latest conference call that the project will not result in any profit for GIFI. A small silver lining over the last two quarters has been positive cash flow from operations. Despite tallying a net loss of over $15 million through Q3 and Q4 of 2018, the company was able to produce over $6 million in cash from their operations over that time frame.

Although the company is having a lot of trouble with its operations, there have been positive developments with the balance sheet. GIFI sold off two underutilized fabrication yards in 2018, resulting in a cash infusion of over $80 million and leaving the company with over $100 million in working capital at the end of 2018 (against a current market cap of $142 million). In addition to bringing in much-needed cash, the sales were encouraging in that GIFI was able to sell the two facilities for more than their recorded book value. The "North" yard sold for $28 million in the fourth quarter for a net gain of $4.1 million and the "South" went for $55 million in Q2 with a net gain of $3.9 million. About half of GIFI's listed book value comes from their physical assets and property, so these recent sale prices indicate that the company's total book value is accurate at worst and understated at best. It is also important to note that GIFI carries no long-term debt, so there are no large debt repayments or interest rate risks to worry about.

The other spot of good news for GIFI is their work backlog. Per the CFO's statements on the earnings call, the backlog at the end of 2018 was about $350 million, up $135 million from the previous year. Further comments in the Q&A section indicated that expected margins on this backlog are relatively low, but I see it as a good sign that the company has been able to win new business. GIFI has also been chosen as the lead engineering contractor for a large compressed gas liquid ("CGL") project currently being organized by SeaOne Holdings LLC. The project would include the construction of CGL export facilities in Mississippi and import facilities in the Caribbean and South America. GIFI has only begun some preliminary planning and scheduling work so far, however, and SeaOne has been attempting to raise financing for the project for well over a year, so the scope of the potential benefit to GIFI is unclear at this point.

Where Earnings Improvements Could Come FromGIFI is currently suffering from low margins in its shipyard division and under-utilization in its fabrication division. The shipyard problem is the most difficult to solve, as the company's backlog is locked in at low margins for the foreseeable future, per comments made on the last earnings call. Using the US Navy tugboat project as an example, management has already stated that the project as a whole will not be profitable, and yet so far GIFI has only completed two of the ten tugboats. The company will need to complete the construction of the remaining eight tugboats to meet their contractual obligations, so their shipyard resources will be tied up with unprofitable work for some time yet. When this project is eventually completed, margins should improve slightly, but it does not sound like the future shipyard backlog is going to raise the division's margins substantially.

If GIFI is going to return to profitability, the earnings will need to come from the fabrication and services areas. On the fabrication front, the sale of their two under-utilized construction yards should help, as the fixed costs associated with running those facilities will no longer be eating into the bottom line. In addition, the company CEO announced the following fabrication project on the last earnings call:

In addition, yesterday we received a letter of intent for our Fabrication division for the construction of a jacket deck and piles for a structure to be installed off the coast of Trinidad. This work is consistent with our traditional historic work for the fabrication division and we were thrilled to be a part of this project.

(Source: Last Earnings Call)

Historically fabrication has been a profitable enterprise for GIFI, so if the trend is now lower operating costs and better utilization of their remaining fabrication facilities, this area of the business has potential to generate profits in the year ahead.

The services division is already profitable, with improving margins and revenue YoY. 2018 gross margins for the division improved to 14%, up from 7% in 2017, at the same time that gross revenue grew 35%. In total, the division returned $9 million in operating profit on $88 million in revenue, compared to $1.9 million in operating profit on $65 million in revenue the previous year. GIFI's total net loss for 2018 was over $20 million, so the services division wouldn't be able to pull the company into profitability on its own, but if GIFI can continue to grow this segment it will certainly help their earnings numbers.

The Investment PlanAs an investor considering buying GIFI stock, my game plan would be to purchase shares at current levels and sell when the stock reaches a PB ratio of one. Two possible catalysts for the share price reaching my target would be an improvement in the company's operating performance in the coming year, or the market better acknowledging the value of the company's assets. I think the recent sale of their two fabrication yards can help with both catalysts by decreasing the fixed costs associated with operating the two facilities and by demonstrating that GIFI is able to sell their assets at or above book value. The 30% current discount to book value, a healthy cash balance, and the company's lack of debt provide an acceptable margin of safety at these levels.

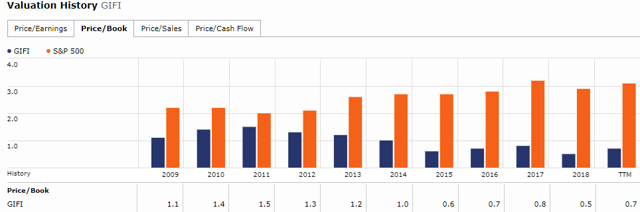

RisksThe two major risks with a GIFI investment would be a steep decline in their operating performance or if the market doesn't decide to assign a higher multiple to the company in a timely fashion. The company's debacle with their latest tugboat project demonstrates that their backlog might not necessarily produce positive profit margins and there could also be negative impacts from further increases in steel tariffs. Looking back over the last five years, the market hasn't been willing to give GIFI a PB ratio of one since 2014, so it is also certainly possible that it takes longer than a year to reach that target, which would eat into an investor's compound rate of return.

(Source: Morningstar)

(Source: Morningstar)

Despite the risks, I believe an investment in GIFI at the current share price of ~$9.50 has a high chance of providing satisfactory results. The company's discount to book value, lack of debt, and strong cash position provide a healthy margin of safety and there are multiple catalysts that could send the stock higher in 2019.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in GIFI over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment