Delafield, Wis. (Stockpickr) -- There isn't a day that goes by on Wall Street when certain stocks trading for $10 a share or less don't experience massive spikes higher. Traders savvy enough to follow the low-priced names and trade them with discipline and sound risk management are banking ridiculous coin on a regular basis.

>>5 Stocks With Big Insider Buying

Just take a look at some of the big movers in the under-$10 complex from Thursday, including UniPixel (UNXL), which is exploding higher by 34%; NewLead Holdings (NEWL), which is soaring higher by 26%; Ventrus Biosciences (VTUS), which is surging higher by 20%; and International Tower Hill Mines (THM), which is moving up by 20%. You don't even have to catch the entire move in lower-priced stocks such as these to make outsized returns when trading.

One low-priced stock that recently spiked sharply higher was precious metals player North American Palladium (PAL), which I highlighted in May 16's "5 Stocks Ready to Break Out" at around 25 cents per share. I mentioned in that piece that shares of North American Palladium were downtrending badly for the last month and change, with shares falling from its high of 60 cents per share to its low of 23 cents per share. This stock had just started to stabilize at around 23 cents to 26 cents per share and it was starting to move within range of triggering a big breakout trade above some near-term overhead resistance levels at 26 cents to 27 cents per share.

>>5 Big Stock Trades to Buy in June

Guess what happened? Shares of North American Palladium triggered that breakout on May 20 with very strong upside volume flows. Volume on that day registered 16.89 million shares, which is well above its three-month average volume of 5.93 million shares. This stock tagged an intraday high that day of 29 cents per share. Shares of PAL briefly pulled for the following week, and then this stock spiked huge again on May 30 to hit an intraday high of 31 cents per share. That represents a gain of close to 20% if you caught that first or second pop and you bought PAL near 25 cents per share to anticipate the breakout.

Traders should continue to watch shares of PAL here, since this stock is still uptrending off its May low of 23 cents per share and it's still trending within range of triggering a major breakout trade. Traders should look for another sharp move higher in PAL if it can manage to take out some key overhead resistance levels at its 50-day moving average of 31 cents per share to around 32 cents per share with high volume.

Low-priced stocks are something that I tweet about on a regular basis. I frequently flag high-probability setups, breakout candidates and low-priced stocks that are acting technically bullish. I like to hunt for low-priced stocks that are showing bullish price and volume trends, since that increases the probability of those stocks heading higher. These setups often produce monster moves higher in very short time frames.

>>3 Stocks Rising on Big Volume

When I trade under-$10 names, I do it almost entirely based off of the charts and technical analysis. I also like to find under-$10 names with a catalyst, but that's secondary to the chart and volume patterns.

With that in mind, here's a look at several under-$10 stocks that look poised to potentially trade higher from current levels.

IsoRay

One under-$10 health care player that's starting to move within range of triggering a near-term breakout trade is IsoRay (ISR), which develops, manufactures and sells isotope-based medical products and devices for the treatment of cancer and other malignant diseases primarily in the U.S. This stock has been on fire so far in 2014, with shares up sharply by 378%.

>>5 Stocks Set to Soar on Bullish Earnings

If you glance at the chart for IsoRay, you'll notice that this stock is starting to spike higher right above some near-term overhead resistance levels at $2.25 to $2.10 a share. That spike is starting to push shares of ISR within range of triggering a near-term breakout trade above some key overhead resistance levels. A trigger of this breakout could easily send shares of ISR soaring sharply higher in the near future.

Traders should now look for long-biased trades in ISR if it manages to break out above its 50-day moving average of $2.43 a share and then once it takes out more resistance levels at $2.49 to $2.50 a share with high volume. Look for a sustained move or close above those levels with volume that registers near or above its three-month average action of 9.25 million shares. If that breakout begins soon, then ISR will set up to re-test or possibly take out its next major overhead resistance levels at $2.82 to $2.84 a share. Any high-volume move above those levels will then give ISR a chance to make a run at $3.47 to its 52-week high at $3.77 a share.

Traders can look to buy ISR off weakness to anticipate that breakout and simply use a stop that sits right below some key near-term support levels at $2.25 or at $2.10 a share. One can also buy ISR off strength once it starts to clear those breakout levels with volume and then simply use a stop that sits a comfortable percentage from your entry point.

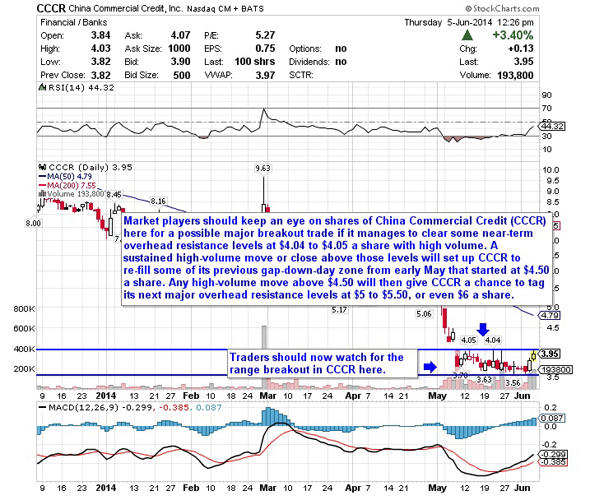

China Commercial Credit

Another under-$10 stock that's starting to trend within range of triggering a big breakout trade is China Commercial Credit (CCCR), which operates as a microcredit company in the People's Republic of China. It provides direct loans, including secured loans comprising guarantee-backed loans, collateral-backed loans and pledge-backed loans; and unsecured loans. This stock has been hit hard by the sellers so far in 2014, with shares off by 46%.

>>5 Stocks Ready for Breakouts

If you take a look at the chart for China Commercial Credit, you'll see that this stock has been downtrending badly for the last three months, with shares dropping sharply lower from its high of $9.63 to its recent 52-week low of $3.56 a share. During that downtrend, shares of CCCR have been consistently making lower highs and lower lows, which is bearish technical price action. That said, shares of CCR have started to stabilize above its 52-week low and it's now quickly moving within range of triggering a big breakout trade above some key near-term overhead resistance levels.

Market players should now look for long-biased trades in CCCR if it manages to break out above some near-term overhead resistance levels at $4.04 to $4.05 a share with high volume. Look for a sustained move or close above those levels with volume that hits near or above its three-month average action of 44,777 shares. If that breakout materializes soon, then CCCR will set up to re-fill some of its previous gap-down-day zone from early May that started at $4.50 a share. Any high-volume move above $4.50 will then give CCCR a chance to tag its next major overhead resistance levels at $5 to $5.50, or even $6 a share.

Traders can look to buy CCCR off weakness to anticipate that breakout and simply use a stop that sits right below its recent 52-week low of $3.56 a share. One can also buy CCCR off strength once it starts to clear those breakout levels with volume and then simply use a stop that sits a comfortable percentage from your entry point.

Zhone Technologies

One under-$10 communications equipment player that's starting to move within range of triggering a big breakout trade is Zhone Technologies (ZHNE), which designs, develops, manufactures and sells communications network equipment for telecommunications, wireless and cable operators worldwide. This stock has been hammered lower by the sellers so far in 2014, with shares off sharply by 41%.

>>5 Tech Stocks to Trade for Gains in June

If you take a glance at the chart for Zhone Technologies, you'll notice that this stock has been uptrending strong for the last month, with shares moving higher from its low of $2.08 to its recent high of $3.21 a share. During that uptrend, shares of ZHNE have been consistently making higher lows and higher highs, which is bullish technical price action. Shares of ZHNE have now started to trend sideways in the near-term, with shares moving between $2.90 on the downside and $3.21 on the upside. Any high-volume move above the upper-end of its recent sideways trading chart pattern could trigger a big breakout trade for shares of ZHNE.

Traders should now look for long-biased trades in ZHNE if it manages to break out above some near-term overhead resistance levels at $ 3.18 to $3.21 a share and then once it clears its 50-day moving average of $3.28 to its recent gap-down-day high of $3.43 a share with high volume. Look for a sustained move or close above those levels with volume that hits near or above its three-month average action of 473,538 shares. If that breakout hits soon, then ZHNE will set up to re-fill some of its previous gap-down-day zone from April that started at $4.24 a share.

Traders can look to buy ZHNE off weakness to anticipate that breakout and simply use a stop that sits right below some key near-term support at $2.90 a share. One can also buy ZHNE off strength once it starts to take out those breakout levels with volume and then simply use a stop that sits a comfortable percentage from your entry point.

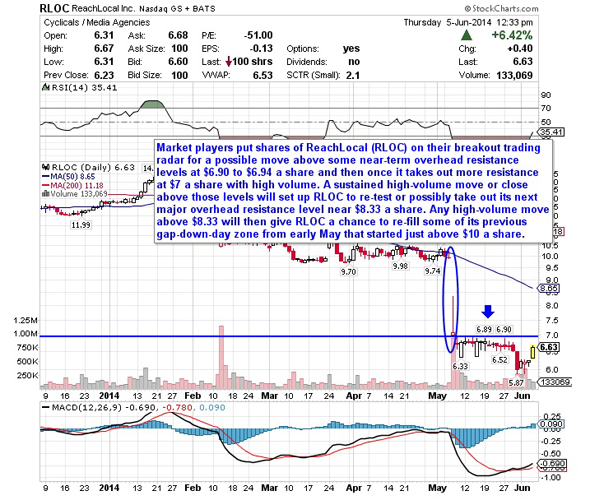

ReachLocal

Another under-$10 advertising player that's starting to spike higher within range of triggering a major breakout trade is ReachLocal (RLOC), which provides a suite of online marketing and reporting solutions to small and medium-sized businesses. This stock has been crushed by the bears so far in 2014, with shares off large by 47%.

>>3 Stocks Spiking on Unusual Volume

If you look at the chart for ReachLocal, you'll see that this stock recently gapped down sharply from over $10 to around $7 with heavy downside volume. Following that move, shares of RLOC continued to slide lower with the stock printing a new 52-week low at $5.87 a share. That said, shares of RLOC have now started to rebound sharply higher off that $5.87 low and it's now quickly moving within range of triggering a major breakout trade above some key near-term overhead resistance levels.

Market players should now look for long-biased trades in RLOC if it manages to break out above some near-term overhead resistance levels at $6.90 to $6.94 a share and then once it takes out more resistance at $7 a share with high volume. Look for a sustained move or close above those levels with volume that registers near or above its three-month average action of 141,747 shares. If that breakout gets underway soon, then RLOC will set up to re-test or possibly take out its next major overhead resistance level near $8.33 a share. Any high-volume move above $8.33 will then give RLOC a chance to re-fill some of its previous gap-down-day zone from early May that started just above $10 a share.

Traders can look to buy RLOC off weakness to anticipate that breakout and simply use a stop that sits right below some support at $6 or near its 52-week low of $ 5.87 a share. One can also buy RLOC off strength once it starts to move above those breakout levels with volume and then simply use a stop that sits a comfortable percentage from your entry point.

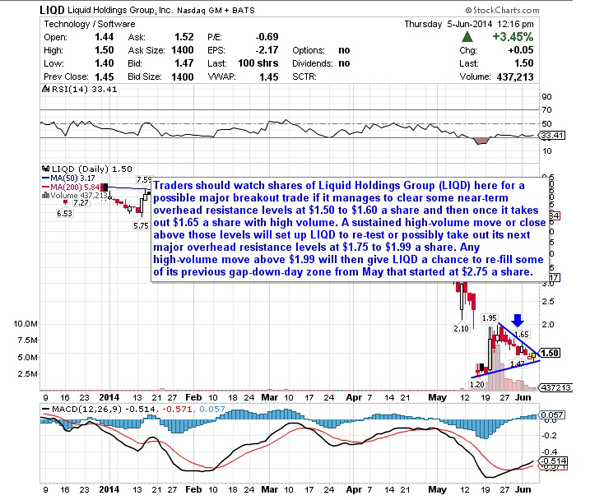

Liquid Holdings Group

One final under-$10 stock that looks ready to make an explosive move to the upside is Liquid Holdings Group (LIQD), which provides proprietary cloud-based trading and portfolio management solution primarily in the U.S. This stock has been absolutely destroyed the short-sellers in 2014, with shares off huge by 78%.

If you take a glance at the chart for Liquid Holdings Group, you'll notice that this stock has been downtrending badly for the last six months, with shares moving lower from over $8 to its recent 52-week low of $1.20 a share. Shares of LIQD recently bounced sharply higher off that $1.20 low to $1.95 a share with massive upside volume. Following that move, shares of LIQD have now drifted lower again hitting an intraday low of $1.40 a share. That said, shares of LIQD are now quickly moving within range of triggering a major breakout trade above a key downtrend line. If this breakout triggers, then LIQD could easily make another monster move higher like it did off that $1.20 low.

Traders should now look for long-biased trades in LIQD if it manages to break out above some near-term overhead resistance levels at $1.50 to $1.60 a share and then once it clears $1.65 a share with high volume. Look for a sustained move or close above those levels with volume that hits near or above its three-month average action of 685,680 shares. If that breakout gets set off soon, then LIQD will set up re-test or possibly take out its next major overhead resistance levels at $1.75 to $1.99 a share. Any high-volume move above $1.99 will then give LIQD a chance to re-fill some of its previous gap-down-day zone from May that started at $2.75 a share.

Traders can look to buy LIQD off weakness to anticipate that breakout and simply use a stop that sits right below its intraday low of $1.40 a share. One can also buy LIQD off strength once it starts trade above that key downtrend line with volume and then simply use a stop that sits a comfortable percentage from your entry point.

To see more hot under-$10 equities, check out the Stocks Under $10 Setting Up to Explode portfolio on Stockpickr.

-- Written by Roberto Pedone in Delafield, Wis.

RELATED LINKS:

>>5 Utility Stocks Hedge Funds Love

>>3 Stocks Triggering Breakouts on Big Volume

>>3 Stocks Under $10 Making Big Moves

Follow Stockpickr on Twitter and become a fan on Facebook.

At the time of publication, author had no positions in stocks mentioned.

Roberto Pedone, based out of Delafield, Wis., is an independent trader who focuses on technical analysis for small- and large-cap stocks, options, futures, commodities and currencies. Roberto studied international business at the Milwaukee School of Engineering, and he spent a year overseas studying business in Lubeck, Germany. His work has appeared on financial outlets including

CNBC.com and Forbes.com. You can follow Pedone on Twitter at www.twitter.com/zerosum24 or @zerosum24.

No comments:

Post a Comment