In the previous week's report, we covered how registered COMEX gold inventories continued to drop even with the rising gold price and this was in contrast to eligible gold inventories, which had a small rise. This week's COMEX data shows a surprising drop in registered gold inventories as they were moved to the eligible category.

This is something that should be very relevant to investors who own physical gold and the gold ETFs (GLD, PHYS, and CEF) because any abnormal inventory declines may signify extraordinary events behind the scenes that would ultimately affect the gold price.

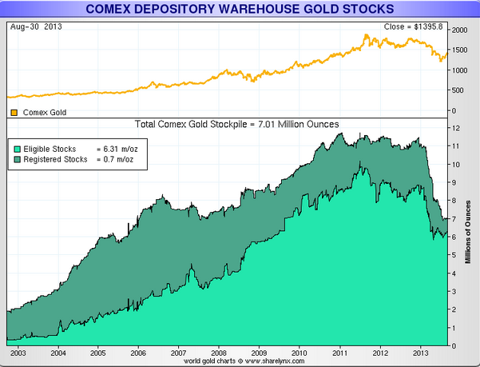

(click to enlarge)

Source: http://www.sharelynx.com

As you can see on the chart above, after the large decline in both registered and eligible gold stocks since the end of 2012, we are now seeing some stabilization in gold inventories. We will take a closer look at these numbers, but let us first explain the COMEX a little more for investors who are unfamiliar with it.

Introduction to COMEX Warehousing

COMEX is an exchange that offers metal warehousing and storage options for its clients. The list of their silver warehouses can be found here and their gold warehouses can be found here. In the case of silver and gold, the metal is stored at these official warehouses on behalf of banks and their clients and can be used to settle futures contracts, transferred between clients, or withdrawn from the warehouse. This offers large holders of precious metals a convenient way to store their metal with minimal storage fees - very convenient indeed if you hold large amounts of gold or silver and you don't want to store them in your basement.

Silver and gold stored in these warehouses can fall into two categories: Eligible and Registered.

Eligible metals are those that conform to the exchange's requirements of size (1000 ounce bars for silver and! 100 ounce bars for gold), purity, and refined by an exchange approved refiner. Eligible metals are stored at COMEX warehouses on behalf of banks or private parties, but are not available for delivery for a futures contract.

Registered metals are similar to eligible metals except that these metals are also available for delivery to settle a futures contract. COMEX issues a daily report on gold, silver, copper, platinum, and palladium stocks, which lists all the metal that is currently stored in COMEX warehouses and how much eligible and registered metal is present.

This information provides investors insight into how much metal is currently backing COMEX futures contracts, what large gold and silver owners are doing with their metals, and how many clients are requesting delivery of their metals. There is a lot more to glean from this information but for the purpose of this article we will focus on the gold drawdown.

This Week's Changes: Large Decline in Registered Gold as it is Transferred to Eligible Gold

Let us now take a deeper look at the gold draw-downs being seen in the COMEX warehouses.

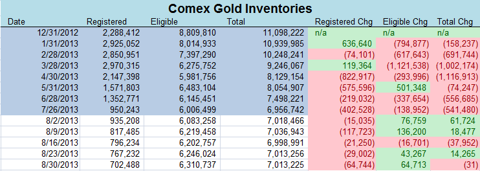

(click to enlarge)

As investors can see in the table above, we have been seeing consistent declines in gold inventories since December. Last week we saw eligible stocks of COMEX gold increase by 64,713 ounces and total COMEX gold decline by 31 ounces (essentially a kilo bar of gold).

Let us now take a look at registered gold stocks.

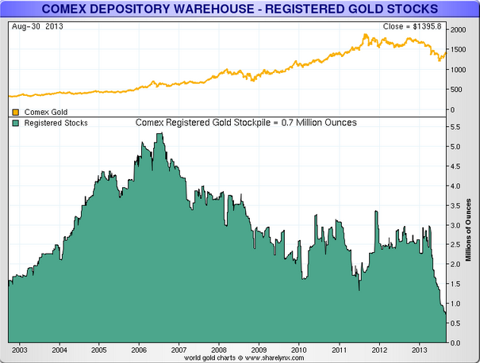

(click to enlarge)

Last week's registered gold stocks had a sizable 64,744 ounce decline (close to 10% of all registered stocks), with most of that being a transfer from registered to eligible status. This means that this gold didn't leave the COMEX warehouses.

! What does! this Mean for Gold Investors

The large declines in COMEX gold inventory seems to have stabilized in the past month as the gold price has rebounded from its July lows. This may suggest that the rumored transfers of gold from COMEX warehouses to Asian gold markets and warehouses may be subsiding.

But what hasn't been stopping is the decline of registered gold inventories. In the past week they dropped by just under 10% to a new all-time low, though the majority of this was due to a change in status from registered to eligible since eligible gold increased by almost the same amount. We're not sure exactly what this means, but it does seem to suggest that investors are increasingly wary about keeping gold available for delivery - though they are not transferring it out of the COMEX anymore.

For gold investors we believe that the COMEX situation is still very bullish. The fact that registered gold continues to decline suggests that there is a lack of desire from gold owners to sell their physical gold at current prices, which is supported by the current backwardation seen in the gold markets. A situation where large owners of gold are not offering much of it to settle gold contracts is a situation that an investor would want to own physical gold.

Therefore the situation is still very bullish for investors in physical gold and the gold ETFs (GLD, CEF, and PHYS). Investors interested in leveraging this situation into higher potential profits may also consider buying gold miners such as Randgold (GOLD), Goldcorp (GG), Yamana Gold (AUY), and any of the other gold miners. Finally, those willing to shoulder much larger risks may consider some of the exploration and micro-cap companies that offer significant profits at a high risk such as Chesapeake Gold (CHPGF.PK), Pretium Resources (PVG), Western Copper (WRN), or any other of the junior exploration companies. Though investors should keep in mind that gold mining companies and explorers do not always rise with a rising gold price - do your! research! before you invest in the miners.

Hot Cheap Stocks To Own Right Now

We will keep an eye on COMEX inventories, but for now we are very curious to see what it will take before gold starts flowing back into the COMEX. Until then the situation remains bullish for gold investors.

Disclosure: I am long SGOL, SIVR, GG, GOLD, CHPGF.PK, WRN, PVG. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

No comments:

Post a Comment