Take-Two Interactive (NASDAQ:TTWO) and really, the video game stocks in general, are in big trouble after reporting earnings. TTWO stock fell by more than 13.5% in Wednesday’s session, but Take-Two isn’t the only one. Electronic Arts (NASDAQ:EA) is also making things worse, down about 13.5% after its quarterly results, while Activision Blizzard (NASDAQ:ATVI) tumbled 10% in sympathy to its two main peers. What’s going on in the video game space, where these names have already been under tremendous pressure?

Earnings are the culprit, although it’s purely salt in the wound considering how far all three of these stocks are from their highs. Electronic Arts disappointed investors with its results, while the mixed third-quarter report from Take-Two caused a larger wave of selling.

Take-Two EarningsThird-quarter bookings growth soared 140% to $1.57 billion on the back of a strong showing from TTWO’s new game, Red Dead Redemption 2. The new release also helped drive revenue of $1.25 billion, smashing the $480.8 million it did in the same period last year. However, the results also missed analysts’ expectations of $1.48 billion.

While the revenue growth was impressive, the outlook was not. The company expects $530 million to $580 million in fourth-quarter revenue, below consensus expectations for $606.2 million.

That said, the company raised its fiscal 2019 outlook. In Q2, management was looking for full-year sales of $2.55 billion to $2.71 billion. It now expects $2.66 billion to $2.71 billion, boosting the lower end. GAAP net income saw a big boost, with expectations going from a range of $202 million to $232 million all the way up to $354 million to $367 million.

That drove earnings per share up from a range of $1.73 to $1.98 per share, to $3.07 to $3.18 per share.

Whoa! I know Fortnite and China and all these other catalysts are cutting into video game stocks, but let’s realize what a big boost this is!

TTWO stock is getting hammered because it came up light on a few metrics, but its overall business is clearly humming. While Battlefield V and FIFA 19 may be disappointing for EA and while Destiny is dealing a blow to Activision, Red Dead and 2K are crushing it for Take-Two.

Compare Brokers

It’s the most attractive video game stock of the bunch right now. But do the charts tell a similar tale?

Trading TTWO Stock

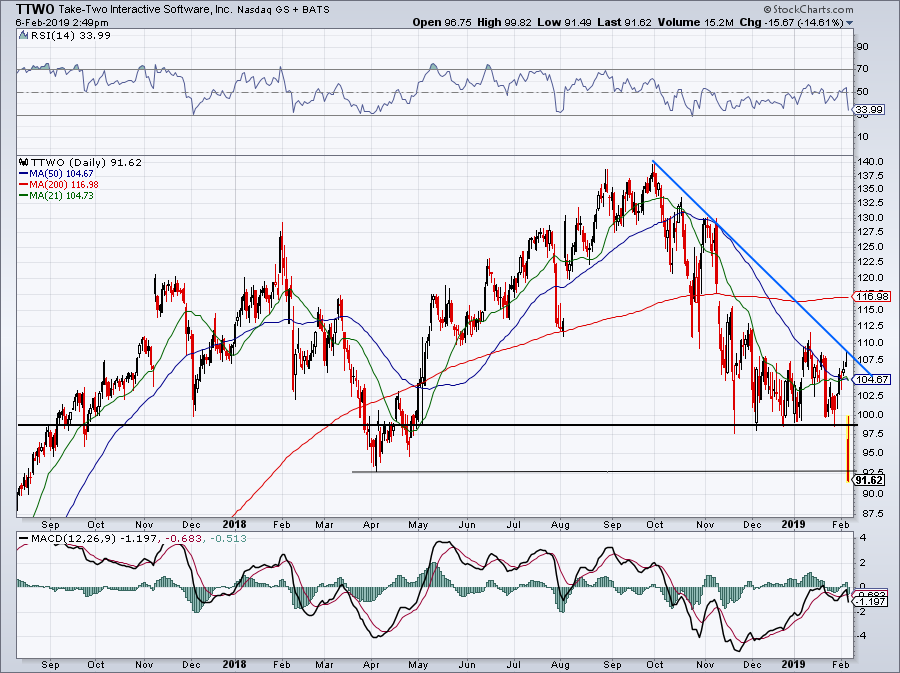

TTWO stock has been under serious pressure since the start of Q4 2018. Shares hit a high right at the start of the quarter near $140. Before long, the stock was bouncing along support at $98, where buyers were constantly stepping in to buoy the stock.

Take-Two stock rallied right up to downtrend resistance ahead of the report, only to fail miserably following the release. It’s not uncommon for video game stocks to suffer post-earnings, as investors try to sort out the headlines. Net bookings cross with revenue and earnings can be tough to read until diving through the press release and listening to the conference call. This can create confusion and lead to selling. Admittedly, I’m not blaming the entire decline on this reason, but it certainly doesn’t help.

With TTWO stock below its prior 52-week low, shares are entering into no man’s land. Simply put, there’s not an easy way to find definitive support.

Back over $92.50 and bulls can look to ride a potential rebound in TTWO stock. However, bears will want to see if this level gives Take-Two stock trouble. If it does, they may look to press it lower. Same goes for a rally back up to $98. Should this level act as resistance, bulls will want to wait until the bears are down thrashing it a bit more. Look to see how TTWO stock shakes out over the next few days. Despite the company’s solid long-term prospects, we have to respect price action first.

Bret Kenwell is the manager and author of Future Blue Chips and is on Twitter @BretKenwell. As of this writing, Bret Kenwell did not hold a position in any of the aforemen

No comments:

Post a Comment