With shares of General Electric (NYSE:GE) trading around $23, is GE an OUTPERFORM, WAIT AND SEE, or STAY AWAY? Let�� analyze the stock with the relevant sections of our CHEAT SHEET investing framework.

T = Trends for a Stock’s Movement

General Electric is a diversified industrial, technology, and financial services company that operates worldwide. The products and services of the company range from aircraft engines, power generation, water processing, and household appliances to medical imaging, business and consumer financing, and industrial products. General Electric�� segments are: Energy Infrastructure, Aviation, Healthcare, Transportation, Home & Business Solutions, and GE Capital. General Electric is a leading provider of a wide range of products and many are essential in daily lives of consumers and companies around the world.

General Electric is planning to spin off its store credit card business in a move that follows the conglomerate�� plan to scale back its financial arm in order to focus on manufacturing, according to The Wall Street Journal. General Electric provides store credit cards to 55 million Americans and brought in $2.2 billion last year. People familiar with the matter who spoke to the Journal said that the company is preparing an IPO of the business, as a straightforward purchase would likely face too many regulatory hurdles.

Best Medical Companies To Buy For 2014: Oncolytics Biotech Inc (ONCY)

Oncolytics Biotech Inc. (Oncolytics), incorporated on April 2, 1998, is a development-stage company. The Company is focused on its research and development of REOLYSIN, which is its cancer therapeutic. REOLYSIN is developed from the reovirus. This virus has been demonstrated in tumour cells bearing an activated Ras pathway. Oncolytics is directing a clinical trial program with the focus of developing REOLYSIN as a human cancer therapeutic. The clinical program includes clinical trials, which it sponsors directly along with Third Party Clinical Trials. Third Party Clinical Trials are clinical trials that are being sponsored by other institutions. As of December 31, 2011, the United States National Cancer Institute (NCI), the University of Leeds and the Cancer Therapy & Research Center at the University of Texas Health Center in San Antonio (CTRC) were sponsoring part of its clinical trial program.

The Company�� clinical trial program has included human trials using REOLYSIN alone, and in combination with radiation and chemotherapy, and delivered via local administration and/or intravenous administration. Oncolytics uses contract toll manufacturers to produce REOLYSIN. On December 31, 2011, the Company had two wholly owned subsidiaries, Oncolytics Biotech (Barbados) Inc. (OBB) and Valens Pharma Ltd. Oncolytics Biotech (US) Inc. and Oncolytics Biotech (U.K.) are wholly owned subsidiaries of OBB.

Advisors' Opinion: - [By Maxx Chatsko]

T-VEC is not your traditional biologic drug. It is actually a bioengineered form of the herpes virus that, once injected into cancerous tumors, replicates, and produces an immune-stimulating protein that puts a bulls eye on cancer cells throughout the body. Despite its promise and intriguing mechanism of action, T-VEC is not in further development at Amgen. However, Oncolytics (NASDAQ: ONCY ) has shown promising results for its bioengineered form of reovirus called Reolysin. Initial phase 3 results showed that 86% of patients taking the drug had reduced tumor mass or growth after six weeks of treatment. �

- [By Sean Williams]

With this in mind, I feel it'd be prudent of biotech-savvy investors to give Oncolytics Biotech (NASDAQ: ONCY ) a closer look.

The big risks

I'm quite aware that there are a lot factors that'd raise a red flag with Oncolytics. Similar to Affymax, you could say that Oncolytics has put all of its eggs in one basket with its lead experimental drug, reolysin. According to Oncolytics' website, including its U.K., Canadian, and U.S. studies, reolysin as either a monotherapy or combination therapy is the basis for all 31 clinical trials! Obviously, if reolysin proves ineffective or unsafe, Oncolytics is going to be a world of hurt.

Best Medical Companies To Buy For 2014: Spectrum Pharmaceuticals Inc.(SPPI)

Spectrum Pharmaceuticals, Inc., a commercial-stage biotechnology company, primarily focuses on oncology and hematology. The company engages in acquiring, developing, and commercializing a broad and diverse pipeline of late-stage clinical and commercial products. It markets Zevalin, a prescribed form of cancer therapy, radioimmunotherapy; and Fusilev, a novel folate analog formulation and the pharmacologically active isomer of the racemic compound, calcium leucovorin. The company?s drugs in late stage development include Apaziquone, an anti-cancer agent; and Belinostat, a histone deacytelase inhibitor. Its drugs in development also include Ozarelix a luteinizing hormone releasing hormone antagonist, which is in Phase II clinical stage; SPI-1620, a peptide agonist of endothelin B receptors, which is in Phase I clinical stage; and RenaZorb, a lanthanum-based nanoparticle phosphate binding agent, which is in preclinical stage. The company was formerly known as NeoTherapeutics, Inc. and changed its name to Spectrum Pharmaceuticals, Inc. in December 2002. Spectrum Pharmaceuticals, Inc. was founded in 1987 and is based in Henderson, Nevada.

Advisors' Opinion: - [By Keith Speights]

Biotech stocks are highly volatile. A good example of this is Spectrum Pharmaceuticals (NASDAQ: SPPI ) . Spectrum rode a wave of generic leucovorin shortages in late 2010 and early 2011 to stock gains of more than 170%. Shares then plunged more than 30% from July through September 2011. But the ride wasn't over yet.

- [By James E. Brumley]

Eight months ago, Spectrum Pharmaceuticals, Inc. (NASDAQ:SPPI) was a train wreck. Shares had plunged from $12.43 to $7.79 on the heels of bad news, and SPPI wouldn't stop bleeding until it hit a low of $6.92 a few days after the big selloff. That bad news? A warning that its full-year sales (and particularly sales of its cancer drug Fusilev) would be well short of expectations.

Cannabis Science, Inc., incorporated on May 4, 2007, is a development-stage company. The Company is engaged in the creation of cannabis-based medicines, both with and without psychoactive properties, to treats disease and the symptoms of disease, as well as for general health maintenance. On February 9, 2012, the Company acquired GGECO University, Inc. (GGECO). On March 21, 2012, the Company acquired Cannabis Consulting Inc. (CCI Group).

The Company is engaged in medical marijuana research and development. The Company works with world authorities on phytocannabinoid science targeting critical illnesses, and adheres to scientific methodologies to develop, produce, and commercialize phytocannabinoid-based pharmaceutical products.

Advisors' Opinion: - [By Bryan Murphy]

The difference between Growlife's leadership and, say that of competitors like Cannabis Science Inc. (OTCMKTS: CBIS) or Medical Marijuana Inc. (OTCMKTS: MJNA), has been relatively well documented here at the SmallCap Network site. I think the way I - well, someone else - put it back on June 25th says it best...."Growlife is sort of the demure girl in the corner who doesn't do shots off her navel in the bar." It may not have sizzle, but it does have substance.

- [By John Udovich]

Although its summer, there has been a steady stream of good news about medical marijuana even though important small cap marijuana stocks�Medical Marijuana Inc (OTCMKTS: MJNA) and Cannabis Science Inc (OTCMKTS: CBIS) have been fairly quietly lately while Growlife Inc (OTCBB: PHOT), a more indirect play on the spread of legalized marijuana, has produced�some news for investors:

Best Medical Companies To Buy For 2014: Inovio Pharmaceuticals Inc (INO)

Inovio Pharmaceuticals, Inc., incorporated on June 29, 1983, is engaged in the development of a new generation of vaccines, called synthetic vaccines, focused on cancers and infectious diseases. The Company's SynCon technology enables the design of universal vaccines capable of providing cross-protection against existing or changing strains of pathogens, such as influenza and human immunodeficiency virus (HIV). The Company's electroporation delivery technology uses brief, controlled electrical pulses to increase cellular uptake of the vaccine. Its clinical programs include cervical dysplasia (therapeutic), avian influenza (preventive), prostate cancer (therapeutic), leukemia (therapeutic), hepatitis C virus (HCV) and HIV vaccines. It is advancing preclinical research and clinical development for a universal seasonal/pandemic influenza vaccine, as well as preclinical work for other products, including malaria and prostate cancer vaccines. Its partners and collaborators include University of Pennsylvania, Drexel University, National Microbiology Laboratory of the Public Health Agency of Canada, Program for Appropriate Technology in Health/Malaria Vaccine Initiative (PATH/MVI), National Institute of Allergy and Infectious Diseases (NIAID), Merck, ChronTech, University of Southampton, United States Military HIV Research Program (USMHRP), the United States Army Medical Research Institute of Infectious Diseases (USAMRIID) and HIV Vaccines Trial Network (HVTN). As of December 31, 2011 it owned 16.1% interest in VGX Int��.

Inovio�� Solution

The Company�� synthetic vaccine platform consists of its SynCon vaccine design process and electroporation delivery technology. It has developed a preclinical and clinical stage pipeline of vaccines. The Company�� synthetic vaccines are designed to prevent a disease (prophylactic vaccines) or treat an existing disease (therapeutic vaccines). Its synthetic vaccine consists of a deoxyribonucleic acid (DNA) plasmid encoding a selected antigen! (s), which is introduced into cells of humans or animals with the purpose of evoking an immune response to the encoded antigen. The Company�� synthetic vaccines are designed to generate specific antibody and/or T-cell responses.

The Company�� SynCon technology provides processes that employ bioinformatics, which combine extensive genetic data and sophisticated algorithms. Its design process uses the genetic make-up of a common antigen(s) from multiple strains of a virus within a viral sub-type or taxonomic group (family) of pathogens, such as HIV, hepatitis C virus (HCV), human papillomavirus (HPV), influenza and other diseases to synthetically create a new antigen for the desired pathogen target that does not exist in nature. Its synthetic vaccine candidates are being delivered into cells of the body using its electroporation (EP) DNA delivery technology.

Cancer Synthetic Vaccines

The Company has two broad types of cancer vaccines: preventive (or prophylactic) vaccines, which are intended to prevent cancer from developing in healthy people, and treatment (or therapeutic) vaccines, which are intended to treat an existing cancer by strengthening the body�� natural defenses against the cancer. Two types of cancer preventive vaccines are available in the United States. The United States Food and Drug Administration (the FDA) has approved two vaccines, Gardasil and Cervarix that protect against infection by the two types of HPV-types 16 and 18-that cause approximately 70% of all cases of cervical cancer worldwide. In addition, Gardasil protects against infection by two additional HPV types, 6 and 11, which are responsible for about 90% of all cases of genital warts in males and females but do not cause cervical cancer.

Cervarix manufactured by GlaxoSmithKline, is composed of virus-like particles (VLPs) made with proteins from HPV types 16 and 18. Cervarix is approved for use in females��ages 10 to 25 for the prevention of cervical cancer caused by! HPV type! s 16 and 18. Gardasil manufactured by Merck, is approved for use in females for the prevention of cervical cancer, and some vulvar and vaginal cancers, caused by HPV types 16 and 18 and for use in males and females for the prevention of genital warts caused by HPV types 6 and 11. The vaccine is approved for these uses in females and males ages 9 to 26. The FDA has also approved a cancer preventive vaccine that protects against hepatitis B virus (HBV) infection.

Inovio�� VGX-3100 is designed to raise immune responses against the E6 and E7 genes of HPV types 16 and 18 that are present in both pre-cancerous and cancerous cells transformed by these HPV types. E6 and E7 are oncogenes that play an integral role in transforming HPV-infected cells into cancerous cells. In March 2011, it initiated a randomized, double-blind Phase II study of VGX-3100 delivered using the CELLECTRA intramuscular electroporation device in women with HPV Type 16 or 18 and diagnosed with, but not yet treated for, cervical intraepithelial neoplasia (CIN) 2/3. The study is designed to enroll 148 subjects. In January 2011, it announced the publication of a scientific paper in the journal Human Vaccines detailing potent immune responses in a preclinical study of its SynCon vaccine for prostate cancer targeting two antigens, prostate specific antigen (PSA) and prostate specific membrane antigen (PSMA).

In January 2011, the Company announced the regulatory approval of a Phase II clinical trial (WIN Trial) to treat leukemia utilizing its new ELGEN 1000 automated vaccine delivery device. The single dose level, Phase II study, called WT1 immunity via DNA fusion gene vaccination in haematological malignancies by intramuscular injection followed by intramuscular electroporation. Cancer Vaccines encodes for hTERT, an antigen related to non-small cell lung, breast and prostate cancers. The vaccine is delivered using its electroporation delivery technology.

Infectious Disease Synthetic Vaccines

In Marc! h 2011, the Company announced the initiation of a follow-on open label, single dose Phase II clinical study in collaboration with ChronTech of the ChronVac-C HCV DNA vaccine delivered using its electroporation technology in treatment naive HCV infected individuals. Its HIV vaccines consist of candidates for HIV prevention, as well as therapy or treatment. PENNVAX-B is designed to target HIV clade B (most commonly found in the United States, North America, Australia and the European Union (EU). PENNVAX-G is designed to target HIV clades A, C and D, which are more commonly found in Asia, Africa, Russia and South America. This Phase I clinical study of PENNVAX-B (HVTN-080) vaccinated 48 healthy, HIV-negative volunteers to assess safety and levels of immune responses generated by Inovio�� PENNVAX-B vaccine delivered with its CELLECTRA electroporation device. PENNVAX-B is a SynCon vaccine that targets HIV gag, pol, and env proteins.

The Company�� VGX-3400X targets H5N1. The vaccine consists of three distinct DNA plasmids coded for a consensus hemagglutinin (HA) antigen derived from different H5N1 virus strains; a consensus neuraminidase (NA) antigen derived from different N1 sequences; and a consensus nucleoprotein (NP) fused to a small portion of the m2 protein (m2E) based on a broader cross-section of influenza viruses in addition to H5N1 and H1N1. Conventional vaccines are strain-specific and have limited ability to protect against genetic shifts in the influenza strains they target. They are therefore modified annually in anticipation of the next flu season�� new strain(s). It is focused on developing DNA-based influenza vaccines able to provide broad protection against known as well as newly emerging, unknown seasonal and pandemic influenza strains.

Animal Health/Veterinary

VGX Animal Health, Inc. (VGX AH), a majority-owned subsidiary, has licensed LifeTide, a plasmid-based growth hormone releasing hormone (GHRH) technology for swine. LifeTide is one of onl! y four DN! A-based treatments approved for use in animals and is the only DNA-based agent delivered using electroporation that has been granted marketing approval (Australia). VGX AH is also developing a GHRH-based treatment for cancer and anemia in dogs and cats. It is developing a synthetic vaccine for foot-and-mouth disease (FMD) administered by its vaccine delivery technology. The FMD virus is one of the most infectious diseases affecting farm animals, including cattle, swine, sheep and goats, and is a serious threat to global food safety.

The Company competes with Crucell N.V, Sanofi-Aventis, Novartis, Inc., GlaxoSmithKline plc, Merck, Pfizer, AstraZeneca, Inc., Novartis, Inc., MedImmune and CSL.

Advisors' Opinion: - [By George Budwell]

Inovio Pharmaceuticals (NYSEMKT: INO ) develops DNA-based vaccines and delivers them using a proprietary electroporation technique. Shares of Inovio have been a roller coaster all year long, and have certainly been the playground of day traders. Last week, Inovio shares lost more than 10% of their value on heavy volume, suggesting the stock may continue to experience downward pressure. This rapid move downward is surprising because the company recently signed a licensing deal with Roche (NASDAQOTH: RHHBY ) to commercialize Inovio's multi-antigen DNA immunotherapies for prostate cancer and hepatitis B. As part of the deal, Inovio received $10 million upfront, and milestone payments could go as high as $412 million.

- [By Sean Williams]

On the clinical data front, Alnylam Pharmaceuticals (NASDAQ: ALNY ) and Inovio Pharmaceuticals (NYSEMKT: INO ) both put investors in their happy place.

- [By Sean Williams]

No fairytale ending

Fairytale endings work great in the movies, but you rarely see them come to fruition in the real world. Small-cap biopharmaceutical Inovio Pharmaceuticals (NYSEMKT: INO ) has seen shares nearly triple since April on the heels of multiple intriguing studies, but will the glass slipper fit over the long term?

Best Medical Companies To Buy For 2014: Terumo (TRUMY.PK)

TERUMO CORPORATION operates in four business segment. The Hospital Products segment is engaged in the manufacture, purchase and sale of hospital medical equipment, pharmaceuticals, peritoneal dialysis and diabetes related products, and the rental of hospital medical equipment and home medical products. The Cardiac and Vascular Area segment is involved in the manufacture, purchase and sale of catheter systems, artificial heart and lungs, as well as artificial blood vessels, the manufacture and sale of therapeutic coils for cerebral aneurysm, sampling equipment and kits for platelet-rich plasma and concentrated bone-marrow cell, and large-bore sheaths. The Blood System segment is engaged in the manufacture, purchase and sale of blood transfusion-related products. The Healthcare segment manufactures and sells healthcare related products. As of March 31, 2012, the Company had 79 subsidiaries and 2 associated companies.

Best Medical Companies To Buy For 2014: Bio-Reference Laboratories Inc.(BRLI)

Bio-Reference Laboratories, Inc. provides clinical laboratory testing services for the detection, diagnosis, evaluation, monitoring, and treatment of diseases primarily in the greater New York metropolitan area. It offers various chemical diagnostic tests, including blood and urine analysis, blood chemistry, hematology services, serology, radio-immuno analysis, toxicology, pap smears, tissue pathology, and other tissue analysis. The company also operates a clinical knowledge management service unit, which uses customer data from laboratory results, pharmaceutical data, claims data, and other data sources to provide administrative and clinical decision support systems. In addition, it operates a Web-based connectivity portal solution for laboratories and physicians to provide laboratory ordering and results to physician customers. The company provides its services directly to physicians, geneticists, hospitals, clinics, and correctional and other health facilities. Bio-Refe rence Laboratories, Inc. was founded in 1981 and is headquartered in Elmwood Park, New Jersey.

Advisors' Opinion: - [By GuruFocus]

An example here is Bio Reference Lab (BRLI). This is a company with a simple business, strong balance sheet and the Predictability Rank of 5-Star. At the price of $19, BRLI was in the top of the Buffett-Munger Screener. But the stock price quickly dropped to below $12 in November 2011. At that point, the company announced a share buyback. The CEO, CFO and COO also bought shares in December at $14 a share. Since then the stock price has doubled.

- [By Geoff Gannon]

But if you can definitely hold a company through a tough market that lasts a few years ��then you can look for a wonderful business to buy and hold at any time. In any market. I found some lovely businesses around the time of the 2000 market peak. They just weren�� big caps, dot coms, etc. They were smaller more mundane businesses. In at least one case ��Bio-Reference Labs (BRLI) ��I made some money (it seemed like a scary big amount at the time) holding the stock for about 2 years but I would��e made a whole lot more if I had just held that one stock through till today. And even now BRLI seems a fine stock to keep holding. So, you see I could��e saved myself a lot of trouble by holding something for more than 10 years. And it wouldn�� have hurt my performance at all. In fact, BRLI has beaten the market by a lot for a very long time. And, yes, the price I paid for BRLI happens to be the most I ever paid for a stock relative to its record earnings. So, I paid a very high price ��for a value investor like me ��for a stock that promptly went on to return around 20% a year for the next 10 years and is now back at almost the exact same P/E ratio where I first bought it.

- [By Geoff Gannon] strong>DreamWorks (DWA)

Read these reports. Look for something that might have interested me. Why would Geoff look at DNB, Chuck E. Cheese, etc.? What got him interested in the stock? Do I see the same thing?

Whenever possible, also read the quarterly earnings call transcripts. You can listen to them too. But it�� easier if you read them and listen to them.

Just listening is a bad idea.

Whenever I can get a transcript of anything ��even Warren Buffett�� appearance on CNBC ��I��l keep a copy of the transcript even when I have a copy of the video (or audio). You can refer back to a transcript easily. You can highlight. You can take notes.

Taking Notes

Now, you are doing those things when reading an annual report, right?

You never just sit down and read an annual report. You always sit down with a pen, a highlighter, a pad of paper, and a calculator. Use the margins of a 10-K ��or your pad of paper ��to jot down notes. Ask questions. Do calculations.

If you ever see a 10-K after I��e read it ��it�� not very white anymore. There�� lots of stuff written in the margins. Mostly it�� questions I was asking myself. But it�� also calculations of numbers the company does not provide.

Numbers to Know

So, for example, in a bank�� 10-K I always write down:

路 Deposits per share

路 Deposits per branch

路 Cost of deposits

路 Texas Ratio

You can actually look up the Texas Ratio of any bank here. And some banks calculate and report cost of deposits the way I like to think about it. But, it�� not common for banks to report deposits per branch ��although small banks will sometimes mention (perhaps in the shareholder letter) what their biggest branch has in deposits. Others may mention how quickly new branches achieved a deposit milestone.

Those are the kinds of numbers I write in the margins of a bank�� 10-K. There will be questions like: ��hy is e

Best Medical Companies To Buy For 2014: Organovo Holdings Inc (ONVO.PK)

Organovo Holdings, Inc. (Organovo), formerly Real Estate Restoration & Rental, Inc., incorporated in 2007, is a development-stage company. The Company has developed and is commercializing a platform technology for the generation of three-dimensional (3D) human tissues that can be employed in drug discovery and development, biological research, and as therapeutic implants for the treatment of damaged or degenerating tissues and organs. On December 28, 2011, Real Estate Restoration and Rental, Inc.�� (RERR) entered into an Agreement and Plan of Merger, pursuant to which RERR merged with its, wholly owned subsidiary, Organovo (Merger Sub). On February 8, 2012, the Company merged with and into Organovo Acquisition Corp. (Acquisition Corp.), a wholly owned subsidiary of Organovo, with the Company surviving the merger as a wholly owned subsidiary of Organovo Holdings (the Merger). As a result of the Merger, Organovo acquired the business of Organovo, Inc.

The C ompany has collaborative research agreements with Pfizer, Inc. (Pfizer) and United Therapeutic Corporation (Unither). As of March 31, 2012, it has five federal grants, including Small Business Innovation Research grants and developed the NovoGen MMX Bioprinter (its first-generation 3D bioprinter). The Company is engaged in the development of specific 3D human tissues to aid Pfizer in discovery of therapies in two areas of interest. In addition, in October 2011, it entered into a research agreement with Unither to establish and conduct a research program to discover treatments for pulmonary hypertension using its NovoGen MMX Bioprinter technology. Additionally, under the research agreement with Unither, the Company granted Unither an option to acquire from the Company a worldwide, royalty-bearing license in certain intellectual property created under the research agreement solely for use in the treatment or prevention of pulmonary hypertension and all other lung diseases.

The Company�� NovoGen MMX Bioprinter is an aut! om! ated device that enables the fabrication of three-dimensional (3D) living tissues comprised of mammalian cells. A custom graphic user interface (GUI) facilitates the 3D design and execution of scripts that direct precision movement of the dispensing heads to deposit cellular building blocks (bio-ink) or supporting hydrogel. The Company is using a third party manufacturer, Invetech Pty., of Melbourne, Australia, to manufacture its NovoGen MMX Bioprinter. Its bioprinting technology and surrounding intellectual property and commercial rights serve as a platform for product generation across multiple markets that employ cell- and tissue-based products and services.

The Company competes with Organogenesis, Advanced BioHealing, Tengion, Genzyme, HumaCyte and Cytograft Tissue Engineering.

Best Medical Companies To Buy For 2014: OncoSec Medical Inc (ONCS)

OncoSec Medical Incorporated, incorporated on February 8, 2008, is an emerging drug-medical device company. The Company focused on designing, developing and commercializing medical approaches for the treatment of solid cancers. In March 2011, the Company acquired from Inovio Pharmaceuticals, Inc. (Inovio) certain assets related to the use of drug-medical device combination products for the treatment of different cancers.

The Company�� acquired assets relate to certain non-deoxyribonucleic acid (DNA) vaccine technology and property relating to selective tumor ablation technologies, which it refers to as the OncoSec Medical System (OMS), a therapy which uses an electroporation device to facilitate delivery of chemotherapy agents, or nucleic acids encoding cytokines, into tumors and/or surrounding tissue for the treatment and diagnosis of various cancers. As of January 24, 2012, the Company had not generated any revenue from operations.

Advisors' Opinion: - [By Bio-Wire]

Another company that has benefitted from Inovio�� newfound attention is OncoSec Medical (OTC: ONCS) ��a newer ��ffshoot�� company that uses a similar but distinctly different electroporation device known as the OncoSec Medical System (OMS) that is based on Inovio�� technology. The specific amplitude and frequency of the OMS electroporation is calibrated such that plasmid delivery into solid tumor masses is fully optimized, while CELLECTRA electroporation is less specialized and focus more on the vaccination of skin cells. The cross-license agreement made between Inovio and Oncosec also covers the two devices for their distinctly different applications.

- [By John Udovich]

Small cap biotech stocks AVEO Pharmaceuticals, Inc (NASDAQ: AVEO), OncoSec Medical Inc (OTCMKTS: ONCS) and MetaStat Inc (OTCBB: MTST) are focused on or are developing treatments or diagnostic technologies for metastatic cancers. In case you aren�� familiar with the term metastasis or metastatic, it�� the�spread of cancer from its primary site to other places in the body as cancer cells break away from a primary tumor, penetrate into lymphatic and blood vessels, circulate through the bloodstream and then grow in a new focus (metastasize) in normal tissues elsewhere in the body. In other words, it�� a dangerous form of cancer, but there are some small cap biotech stocks targeting it for diagnostics or treatment:

Bloomberg

Bloomberg  Twitter IPO may value firm at $11.1 billion

Twitter IPO may value firm at $11.1 billion

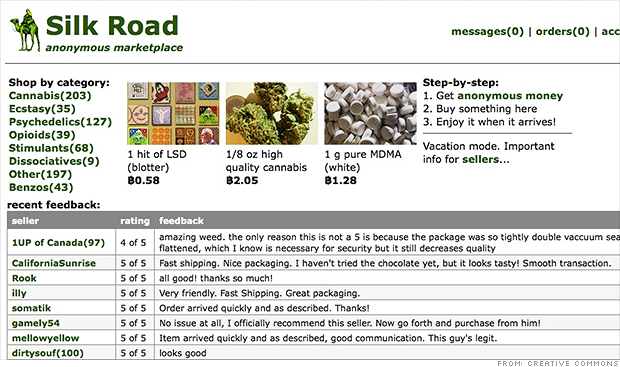

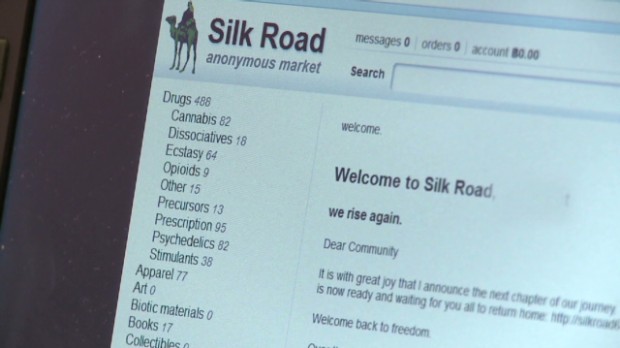

A look at rebuilt drug bazaar Silk Road

A look at rebuilt drug bazaar Silk Road  Ford Motors

Ford Motors  Tesla

Tesla  Enlarge Image Tesla's Model S.

Enlarge Image Tesla's Model S.  AlamyA US Navy X-47B Unmanned Combat Air System aircraft is towed into the hanger bay aboard the aircraft carrier USS George H.W. Bush -- the first aircraft carrier to successfully catapult launch an unmanned aircraft from its flight deck. With a fiscal 2013 defense budget of nearly $614 billion, the United States is widely known to be a big spender on defense. By some estimates, U.S. defense spending accounts for nearly 60 percent of the $1.19 trillion the top 10 military powers spent on defense in 2011. In fact, our country allocates more than five times more money to defense than does its closest spending rival, China. And that's not the half of it. In the cutting-edge field of military unmanned aerial vehicles, the United States has such a huge lead over its rivals that it makes their combined UAV fleets look like a rounding error in a world that's essentially 100 percent dominated by U.S. drones. Pax Americana As The Wall Street Journal recently reported, the U.S. military commands a fleet of 429 "large drone" aircraft such as the General Atomics Predator and Northrop Grumman (NOC) Global Hawk. Meanwhile, America's smaller drones, built by everyone from Boeing (BA) to Textron (TXT) to tiny AeroVironment (AVAV), maker of the ubiquitous Raven man-portable UAV, number in the thousands. In contrast, the military of the United Kingdom, not even a U.S. rival but a close ally, boasts a fleet of precisely 10 large drones, most of which we built for them, and the rest imported from Israel. Italy has nine, France, four, and Germany has three. As a result, when allied forces need a drone to "put eyes" on a target, more often than not, they have to ring up the U.S. military to get one. Who You Gonna Call? For allied nations, that has to be embarrassing -- but it's a situation unlikely to change soon. As the Journal reports, European defense giant European Aeronautic Defence & Space (EADSY), the parent company of Airbus, is only just now beginning to test a prototype pilotless helicopter -- whereas in the U.S., pilotless helos from Northrop called "Fire Scouts" have been in active service for years. True, European defense contractors such as EADS, BAE Systems (LSE: BA), and Dassault Aviation have succeeded in putting a few smaller drones in the air, and have dreams of prototypes of larger craft. But budget cuts, exacerbated by an ongoing economic crisis and also "territorial" squabbling among EU governments over ownership of defense companies, have hobbled the Continent's ability to develop robotic aircraft of any real size or capability. By some estimates, Europe is as much as 10 years behind the U.S. in drone technology development. The World Is Our Unmanned Oyster In the absence of a "homegrown" drone program, Europe remains largely dependent on the kindness of strangers for its drones -- in other words, the willingness of U.S. companies such as Northrop and General Atomics, and Israeli firms like Israel Aerospace Industries, to sell them the large drones they need. Right now, France is in the process of petitioning the U.S. Congress to sell it 16 General Atomics Reaper drones. If and when the sale goes through, though, it should mean at least $1.5 billion for General Atomics. In future years, U.S. defense contractors could rack up even bigger sales. Australia, for example, already a patron of Israel's IAI, is gearing up to spend hundreds of millions of dollars on a new maritime surveillance drone (dubbed "BAMS") being developed by Northrop Grumman. Aerospace consulting firm Teal Group, based in Reston, Va., estimates that by 2023, the global drone market could grow to as much as $11.6 billion in annual sales. For the time being -- and perhaps for as much as a decade in the future, until Europe catches up -- most of these sales should be ours for the taking.

AlamyA US Navy X-47B Unmanned Combat Air System aircraft is towed into the hanger bay aboard the aircraft carrier USS George H.W. Bush -- the first aircraft carrier to successfully catapult launch an unmanned aircraft from its flight deck. With a fiscal 2013 defense budget of nearly $614 billion, the United States is widely known to be a big spender on defense. By some estimates, U.S. defense spending accounts for nearly 60 percent of the $1.19 trillion the top 10 military powers spent on defense in 2011. In fact, our country allocates more than five times more money to defense than does its closest spending rival, China. And that's not the half of it. In the cutting-edge field of military unmanned aerial vehicles, the United States has such a huge lead over its rivals that it makes their combined UAV fleets look like a rounding error in a world that's essentially 100 percent dominated by U.S. drones. Pax Americana As The Wall Street Journal recently reported, the U.S. military commands a fleet of 429 "large drone" aircraft such as the General Atomics Predator and Northrop Grumman (NOC) Global Hawk. Meanwhile, America's smaller drones, built by everyone from Boeing (BA) to Textron (TXT) to tiny AeroVironment (AVAV), maker of the ubiquitous Raven man-portable UAV, number in the thousands. In contrast, the military of the United Kingdom, not even a U.S. rival but a close ally, boasts a fleet of precisely 10 large drones, most of which we built for them, and the rest imported from Israel. Italy has nine, France, four, and Germany has three. As a result, when allied forces need a drone to "put eyes" on a target, more often than not, they have to ring up the U.S. military to get one. Who You Gonna Call? For allied nations, that has to be embarrassing -- but it's a situation unlikely to change soon. As the Journal reports, European defense giant European Aeronautic Defence & Space (EADSY), the parent company of Airbus, is only just now beginning to test a prototype pilotless helicopter -- whereas in the U.S., pilotless helos from Northrop called "Fire Scouts" have been in active service for years. True, European defense contractors such as EADS, BAE Systems (LSE: BA), and Dassault Aviation have succeeded in putting a few smaller drones in the air, and have dreams of prototypes of larger craft. But budget cuts, exacerbated by an ongoing economic crisis and also "territorial" squabbling among EU governments over ownership of defense companies, have hobbled the Continent's ability to develop robotic aircraft of any real size or capability. By some estimates, Europe is as much as 10 years behind the U.S. in drone technology development. The World Is Our Unmanned Oyster In the absence of a "homegrown" drone program, Europe remains largely dependent on the kindness of strangers for its drones -- in other words, the willingness of U.S. companies such as Northrop and General Atomics, and Israeli firms like Israel Aerospace Industries, to sell them the large drones they need. Right now, France is in the process of petitioning the U.S. Congress to sell it 16 General Atomics Reaper drones. If and when the sale goes through, though, it should mean at least $1.5 billion for General Atomics. In future years, U.S. defense contractors could rack up even bigger sales. Australia, for example, already a patron of Israel's IAI, is gearing up to spend hundreds of millions of dollars on a new maritime surveillance drone (dubbed "BAMS") being developed by Northrop Grumman. Aerospace consulting firm Teal Group, based in Reston, Va., estimates that by 2023, the global drone market could grow to as much as $11.6 billion in annual sales. For the time being -- and perhaps for as much as a decade in the future, until Europe catches up -- most of these sales should be ours for the taking. Technical support, in the shape of a double bottom, developed on the weekly chart at the 200-week simple moving average. The price is now above the 50-week simple moving average. Technically, further upside to retest the $700 highs appears probable.

Technical support, in the shape of a double bottom, developed on the weekly chart at the 200-week simple moving average. The price is now above the 50-week simple moving average. Technically, further upside to retest the $700 highs appears probable..jpg) Market research firm IDC projects a 40% increase in smartphone sales in 2014. This includes more than a billion smartphones and tablets being sold to emerging markets such as the BRIC nations (Brazil, Russia, India and China). Apple is in position to gain market share based on this growth, and the cheaper version of the iPhone 5 will surely help in these markets.

Market research firm IDC projects a 40% increase in smartphone sales in 2014. This includes more than a billion smartphones and tablets being sold to emerging markets such as the BRIC nations (Brazil, Russia, India and China). Apple is in position to gain market share based on this growth, and the cheaper version of the iPhone 5 will surely help in these markets..jpg) While I don't generally pay much attention to most Wall Street firm projections, Cantor Fitzgerald has initiated a "buy" recommendation and a $777 price target on Apple's shares. I have respect for Cantor Fitzgerald, and when its forecast supports my own research, if nothing else it raises confidence in my price targets.

While I don't generally pay much attention to most Wall Street firm projections, Cantor Fitzgerald has initiated a "buy" recommendation and a $777 price target on Apple's shares. I have respect for Cantor Fitzgerald, and when its forecast supports my own research, if nothing else it raises confidence in my price targets. .jpg) Apple is holding its first-ever media event in China on Sept. 11, a day after the new iPhones will be officially announced.

Apple is holding its first-ever media event in China on Sept. 11, a day after the new iPhones will be officially announced.