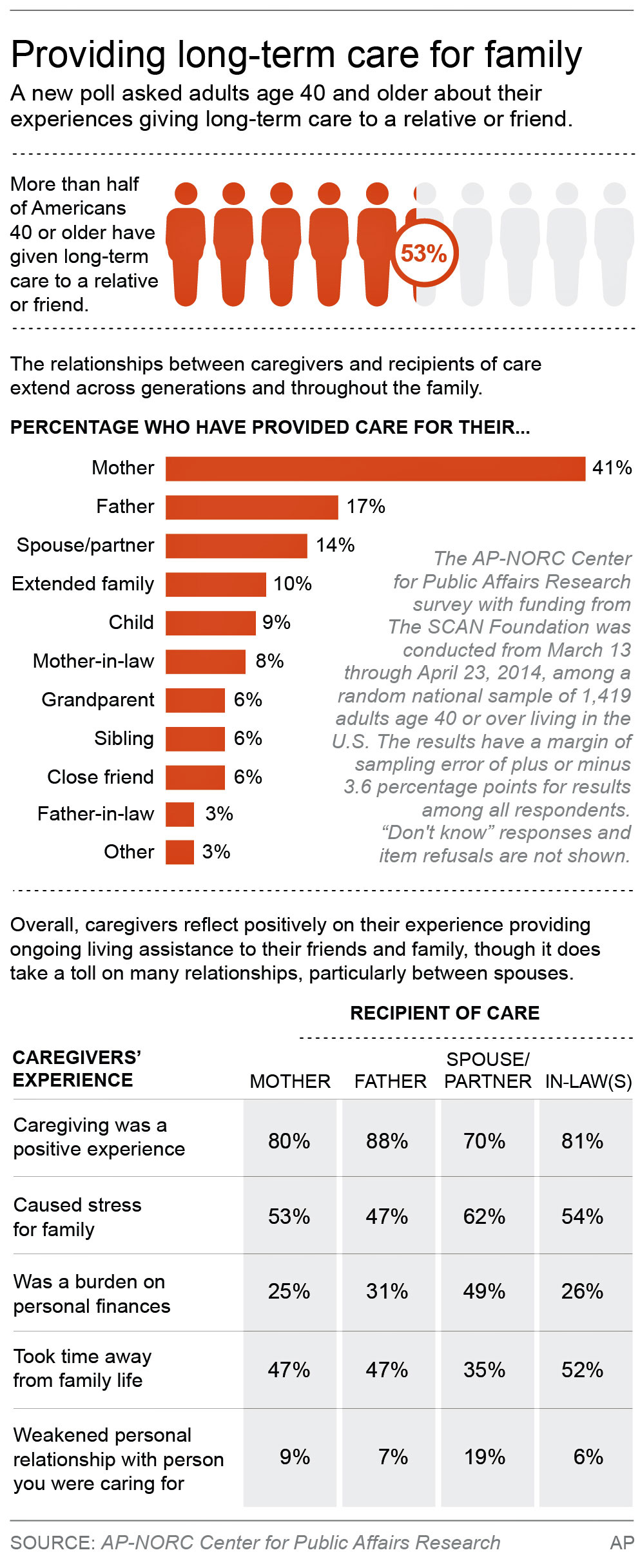

Stephen Lance Dennee/AP WASHINGTON -- You promise "in sickness and in health," but a new poll shows becoming a caregiver to a frail spouse causes more stress than having to care for mom, dad or even the in-laws. Americans 40 and older say they count on their families to care for them as they age, with good reason: Half of them already have been caregivers to relatives or friends, the poll found. But neither the graying population nor the loved ones who expect to help them are doing much planning for long-term care. In fact, people are far more likely to disclose their funeral plans to friends and family than reveal their preferences for assistance with day-to-day living as they get older, according to the poll by The Associated Press-NORC Center for Public Affairs Research. And while 8 in 10 people who've been caregivers called it a positive experience, it's also incredibly difficult. "Your relationship changes. Life as you know it becomes different," said Raymond Collins, 62, of Houston, who retired early in part to spend time with his wife, Karen. Diagnosed with multiple sclerosis 15 years ago, her mobility has deteriorated enough that she now uses a wheelchair. Collins, a former business manager for an oil company, said he has felt stress, frustration and, at times, anger. "The traditional vows are through sickness and health, for richer or poorer, for better or worse, etc.," he said. "At the age of 25 and 32, you say those things and you're high on love and healthy, and life is all in front of you. The meanings of those words are pretty much lost, even when you concentrate on them." Still, he said caregiving has strengthened his marriage commitment in ways he couldn't foresee as a newlywed nearly 37 years ago. Caregiving may start with driving a loved one to the doctor or helping with household chores, but progress to hands-on care, such as bathing. Increasingly, family members are handling tasks once left to nurses, such as the care of open wounds or injections of medication. With a rapidly aging population, more families will face those responsibilities: Government figures show nearly 7 in 10 Americans will need long-term care at some point after they reach age 65. Yet just 20 percent of those surveyed think it is likely they will need such care someday. Almost twice as many, 39 percent, are deeply concerned about burdening their families. Contrary to popular belief, Medicare doesn't pay for the most common types of long-term care -- and last year, a bipartisan commission appointed by Congress couldn't agree on how to finance those services, either. But the AP-NORC Center poll found nearly 6 in 10 Americans 40 and older support some type of government-administered long-term care insurance program, a 7-point increase from last year's AP survey. The poll also found broad support for a range of policy proposals: More than three-fourths favor tax breaks to encourage saving for long-term care or for purchasing long-term care insurance. Only a third favor a requirement to purchase such coverage. Some 8 in 10 want more access to community services that help the elderly live independently. More than 70 percent support respite care programs for family caregivers and letting people take time off work or adjust their schedules to accommodate caregiving. Two-thirds want a caregiver designated on their loved one's medical charts who must be included in all discussions about care. Oklahoma this month became the first state to pass the AARP-pushed Caregiver Advice, Record and Enable -- or CARE -- Act that requires hospitals to notify a family caregiver when a loved one is being discharged and to help prepare that caregiver for nursing the patient at home.

Stephen Lance Dennee/AP WASHINGTON -- You promise "in sickness and in health," but a new poll shows becoming a caregiver to a frail spouse causes more stress than having to care for mom, dad or even the in-laws. Americans 40 and older say they count on their families to care for them as they age, with good reason: Half of them already have been caregivers to relatives or friends, the poll found. But neither the graying population nor the loved ones who expect to help them are doing much planning for long-term care. In fact, people are far more likely to disclose their funeral plans to friends and family than reveal their preferences for assistance with day-to-day living as they get older, according to the poll by The Associated Press-NORC Center for Public Affairs Research. And while 8 in 10 people who've been caregivers called it a positive experience, it's also incredibly difficult. "Your relationship changes. Life as you know it becomes different," said Raymond Collins, 62, of Houston, who retired early in part to spend time with his wife, Karen. Diagnosed with multiple sclerosis 15 years ago, her mobility has deteriorated enough that she now uses a wheelchair. Collins, a former business manager for an oil company, said he has felt stress, frustration and, at times, anger. "The traditional vows are through sickness and health, for richer or poorer, for better or worse, etc.," he said. "At the age of 25 and 32, you say those things and you're high on love and healthy, and life is all in front of you. The meanings of those words are pretty much lost, even when you concentrate on them." Still, he said caregiving has strengthened his marriage commitment in ways he couldn't foresee as a newlywed nearly 37 years ago. Caregiving may start with driving a loved one to the doctor or helping with household chores, but progress to hands-on care, such as bathing. Increasingly, family members are handling tasks once left to nurses, such as the care of open wounds or injections of medication. With a rapidly aging population, more families will face those responsibilities: Government figures show nearly 7 in 10 Americans will need long-term care at some point after they reach age 65. Yet just 20 percent of those surveyed think it is likely they will need such care someday. Almost twice as many, 39 percent, are deeply concerned about burdening their families. Contrary to popular belief, Medicare doesn't pay for the most common types of long-term care -- and last year, a bipartisan commission appointed by Congress couldn't agree on how to finance those services, either. But the AP-NORC Center poll found nearly 6 in 10 Americans 40 and older support some type of government-administered long-term care insurance program, a 7-point increase from last year's AP survey. The poll also found broad support for a range of policy proposals: More than three-fourths favor tax breaks to encourage saving for long-term care or for purchasing long-term care insurance. Only a third favor a requirement to purchase such coverage. Some 8 in 10 want more access to community services that help the elderly live independently. More than 70 percent support respite care programs for family caregivers and letting people take time off work or adjust their schedules to accommodate caregiving. Two-thirds want a caregiver designated on their loved one's medical charts who must be included in all discussions about care. Oklahoma this month became the first state to pass the AARP-pushed Caregiver Advice, Record and Enable -- or CARE -- Act that requires hospitals to notify a family caregiver when a loved one is being discharged and to help prepare that caregiver for nursing the patient at home.  Just 30 percent in this age group who say they'll likely care for a loved one in the next five years feel prepared to do so. Women tend to live longer than men and consequently most family caregivers, 41 percent, assist a mother. Seventeen percent have cared for a father, and 14 percent have cared for a spouse or partner, the poll found. The tug on the sandwich generation -- middle-aged people caring for both children and older parents, often while holding down a job -- has been well-documented, and the new poll found half of all caregivers report the experience caused stress in the family. But spouses were most likely to report that stress and to say caregiving weakened their relationship with their partner and burdened their finances. Spouses are more likely to handle complex care tasks, on duty 24-7 with less help from family and friends, said Lynn Feinberg, a caregiving specialist at AARP. Physically, that can be harder because spouse caregivers tend to be older: In the AP-NORC poll, the average age of spouse caregivers was 67, compared with 58 for people who've cared for a parent. Virginia Brumley, 79, of Richmond, Indiana, cared for her husband, Jim, for nearly five years while he suffered dementia and Parkinson's syndrome, care that eventually required feeding, dressing and diapering him. "I think I loved him more after I started caring for him. I saw what a wonderful person he was: his [positive] attitude, his kindness, his acceptance of things," she said. But he lived his last 11 months in a nursing home because "I couldn't handle him anymore," Brumley said. "He was too big for me. He was as helpless as a baby." The AP-NORC Center survey was conducted by telephone March 13 to April 23 among a random national sample of 1,419 adults age 40 or older, with funding from the SCAN Foundation. Results for the full survey have a margin of sampling error of plus or minus 3.6 percentage points. -.

Just 30 percent in this age group who say they'll likely care for a loved one in the next five years feel prepared to do so. Women tend to live longer than men and consequently most family caregivers, 41 percent, assist a mother. Seventeen percent have cared for a father, and 14 percent have cared for a spouse or partner, the poll found. The tug on the sandwich generation -- middle-aged people caring for both children and older parents, often while holding down a job -- has been well-documented, and the new poll found half of all caregivers report the experience caused stress in the family. But spouses were most likely to report that stress and to say caregiving weakened their relationship with their partner and burdened their finances. Spouses are more likely to handle complex care tasks, on duty 24-7 with less help from family and friends, said Lynn Feinberg, a caregiving specialist at AARP. Physically, that can be harder because spouse caregivers tend to be older: In the AP-NORC poll, the average age of spouse caregivers was 67, compared with 58 for people who've cared for a parent. Virginia Brumley, 79, of Richmond, Indiana, cared for her husband, Jim, for nearly five years while he suffered dementia and Parkinson's syndrome, care that eventually required feeding, dressing and diapering him. "I think I loved him more after I started caring for him. I saw what a wonderful person he was: his [positive] attitude, his kindness, his acceptance of things," she said. But he lived his last 11 months in a nursing home because "I couldn't handle him anymore," Brumley said. "He was too big for me. He was as helpless as a baby." The AP-NORC Center survey was conducted by telephone March 13 to April 23 among a random national sample of 1,419 adults age 40 or older, with funding from the SCAN Foundation. Results for the full survey have a margin of sampling error of plus or minus 3.6 percentage points. -. Copyright 2014 The Associated Press. All rights reserved. This material may not be published, broadcast, rewritten or redistributed. More from The Associated Press

•Stayful Offers Last-Minute Boutique Hotel Deals •AstraZeneca Board Rejects Pfizer's 'Final' Offer •GM Fined Maximum $35 Million Over Ignition Switch Recall

Sunday, May 31, 2015

Poll: Caring For Spouse More Stressful Than Mom

Saturday, May 30, 2015

Best Shipping Stocks To Invest In Right Now

Best Shipping Stocks To Invest In Right Now: Ishares Msci Italy Index Fund (EWI)

iShares MSCI Italy Index Fund (the Fund) seeks to provide investment results that correspond generally to the price and yield performance of publicly traded securities in the aggregate in the Italian market, as measured by the MSCI Italy Index (the Index). The Index seeks to measure the performance of the Italian equity market. The Index is a capitalization-weighted index that aims to capture 85% of the (publicly available) total market capitalization. Component companies are adjusted for available float and must meet objective criteria for inclusion in the Index. The Index is reviewed quarterly.

The Fund invests in a representative sample of securities included in the Index that collectively has an investment profile similar to the Index. The Fund's investment advisor is Barclays Global Fund Advisors.

Advisors' Opinion:- [By Dan Caplinger]

4. Italy

Some developed markets have also outperformed the Dow Jones Industrials. Italy's market is up 14%, and even the euro's weakness has given U.S. investors in iShares MSCI Italy (NYSEMKT: EWI ) a 12% gain. Europe has made progress toward emerging from recession, and Italy has recovered more than some of its economically healthier peers because of the close brush with sovereign-debt issues that cut confidence in the Mediterranean nation's stock market substantially. As long as the government can keep debt under control, Italy could keep outperforming the Dow. - [By Tom Aspray]

This is quite a bit better than the 9.2% gain of the iShares MSCI Italy (EWI) or the 8.9% rise in the iShares MSCI Austria (EWO). All three have done significantly better than the Spyder Trust (SPY), which is up 3.6%. The French and German country ETFs have not yet moved above their late 2013 highs.

source fr! om Top Stocks For 2015:http://www.topstocksblog.com/best-shipping-stocks-to-invest-in-right-now.html

Friday, May 29, 2015

10 Best Insurance Stocks To Invest In Right Now

10 Best Insurance Stocks To Invest In Right Now: Aspen Insurance Holdings Ltd (AHL)

Aspen Insurance Holdings Limited (Aspen Holdings), incorporated on May 23, 2002, is a holding company. The Company conducts insurance and reinsurance business through its subsidiaries in three jurisdictions: Aspen Insurance UK Limited (Aspen U.K.) and Aspen Underwriting Limited (AUL), corporate member of Syndicate 4711 at Lloyd's of London (United Kingdom), Aspen Bermuda Limited (Aspen Bermuda) and Aspen Specialty Insurance Company (Aspen Specialty) and Aspen American Insurance Company (AAIC). Aspen UK. also has branches in Paris (France), Zurich (Switzerland), Dublin (Ireland), Cologne (Germany), Singapore, Australia and Canada. It operates in the global markets for property and casualty insurance and reinsurance. It manages its insurance and reinsurance businesses as two distinct underwriting segments, Aspen Insurance and Aspen Reinsurance (Aspen Re), to serve its global customer base. Its insurance segment is consisted of property, casualty, marine, energy and transp ortation insurance and financial and professional lines insurance. Its reinsurance segment is consisted of property reinsurance (catastrophe and other), casualty reinsurance and specialty reinsurance. In April 2013, the reinsurance segment of the Company announced the formation of a new division, Aspen Capital Markets.

In the Company's insurance segment, property, casualty and financial and professional lines insurance business is written in the London Market through Aspen U.K. and in the United States through Aspen Specialty and AAIC. Its marine, energy and transportation insurance business is written through Aspen U.K. and AUL, which is the corporate member of Syndicate 4711 at Lloyd's of London (Lloyd's), managed by Aspen Managing Agency Limited (AMAL). It also writes casualty business through AUL. In reinsurance, property r! einsurance business is assumed by Aspen Bermuda and Aspen U.K. The property reinsurance business written in the United States is wr itten by Aspen Re America and ARA-CA as reinsurance intermed! iaries with offices in Connecticut, Illinois, Florida, New York, Georgia and California. The business written in the United States is produced by Aspen Re America.

Reinsurance

The Company's reinsurance segment consists of property catastrophe reinsurance, other property reinsurance (risk excess, pro rata, risk solutions and facultative), casualty reinsurance (the United States treaty, international treaty and global facultative) and specialty reinsurance (credit and surety, structured, agriculture and specialty). Property catastrophe reinsurance is written on a treaty excess of loss basis where it provides protection to an insurer for an agreed portion of the total losses from a single event in excess of a specified loss amount. In the event of a loss, contracts provide for coverage of a second occurrence following the payment of a premium to reinstate the coverage under the contract, which is referred to as a reinstatement premium. The coverage p rovided under excess of loss reinsurance contracts may be on a global basis or limited in scope to selected regions or geographical areas.

Other property reinsurance includes risk excess of loss and proportional treaty reinsurance, facultative or single risk reinsurance and its risk solutions business. Risk excess of loss reinsurance provides coverage to a reinsured where it experiences a loss in excess of its retention level on a single risk basis. Proportional contracts involve close client relationships, including regular audits of the cedants' data. Its risk solutions business writes property insurance risks for a select group of the United States program managers. Casualty reinsurance is written on an excess of loss, proportional and facultative basis and consists of the United States treaty, international treaty and ca! sualty fa! cultative. Its United States treaty business consists of exposures to workers' compensation (including catastrophe), medical ma lpractice, general liability, auto liability, professional l! iability ! and excess liability, including umbrella liability. Its international treaty business reinsures exposures respect to general liability, auto liability, professional liability, workers' compensation and excess liability.

Specialty reinsurance is written on an excess of loss and proportional basis and consists of credit and surety reinsurance, structured risks, agriculture reinsurance and other specialty lines. Its credit and surety reinsurance business consists of trade credit reinsurance, international surety reinsurance (mainly European, Japanese and Latin American risks and excluding the United States) and a political risks portfolio. Its agricultural reinsurance business is written on a treaty basis covering crop and multi-peril business. Other specialty lines include reinsurance treaties and some insurance policies covering policyholders' interests in marine, energy, liability aviation, space, contingency, terrorism, nuclear, personal accident and crop r einsurance. A percentage of the property reinsurance contracts it writes exclude coverage for losses arising from the peril of terrorism. These contracts exclude coverage protecting against nuclear, biological or chemical attack.

The Company competes Arch Capital Group Ltd., Axis Capital Holdings Limited (Axis), Endurance Specialty Holdings Ltd. (Endurance), Everest Re Group Limited, Lancashire Holdings Limited, Montpelier Re Holdings Limited, PartnerRe Ltd., Platinum Underwriters Holdings Ltd., Renaissance Re Holdings Ltd., Validus Holdings Ltd., XL Capital Ltd. (XL) and various Lloyd's syndicates.

Insurance

The Company's insurance segment consists of property insurance, casualty insurance, marine, energy and transportation insurance and financial and professional lines insurance. Its p! roperty i! nsurance line comprises the United Kingdom commercial property and construction business and the United States property business. Property insurance provides physical damage and business interruption! coverage! for losses arising from weather, fire, theft and other causes. The United States commercial property team covers mercantile, manufacturing, municipal and commercial real estate business. The United States property also includes its program business, which writes property insurance risks for a select group of the United States program managers. The United Kingdom commercial team's client base is predominantly the United Kingdom institutional property owners, middle market corporates and public sector clients.

The Company's casualty insurance line comprises commercial liability, global excess casualty, the United States casualty insurance and environmental liability, written on a primary, quota share and facultative basis. Commercial liability is written in the United Kingdom and provides employers' liability coverage and public liability coverage for insureds domiciled in the United Kingdom and Ireland. The global excess casualty line comprises risk-manage d insureds globally and covers risks at points, including general liability, commercial and residential construction liability, life science, railroads, trucking, product and public liability and associated types of cover found in general liability policies in the global insurance market. The United States casualty account consists of lines written within the general liability and umbrella liability insurance sectors. Coverage on its general liability line is offered on those risks that are miscellaneous, products liability, contractors (general contractors and artisans), real estate and retail risks and other general liability business. The United States environmental account provides contractors' pollution liability and pollution legal liability across industry segments that have environmental regulatory drivers and! contract! ual requirements for coverage, including real estate and public entities, contractors and engineers, energy contractors and environmental contractors and consultants. The business is written in both the primar! y and exc! ess insurance markets.

The Company's marine, energy and transportation insurance line comprises marine, energy and construction (M.E.C.) liability, energy physical damage, marine hull, specie, inland marine and ocean risks and aviation, written on a primary, quota share and facultative basis. The M.E.C. liability business includes marine liability cover related to the liabilities of ship-owners and port operators, including reinsurance of Protection and Indemnity Clubs (P&I Clubs). It also provides liability cover for companies in the oil and gas sector, both onshore and offshore and in the power generation and the United States commercial construction sectors. Energy physical damage provides insurance cover against physical damage losses in addition to Operators Extra Expenses (OEE) for companies operating in the oil and gas exploration and production sector. The marine hull team insures physical damage for ships (including war and associated perils) and rel ated marine assets. The specie business line focuses on the insurance of property items on an all risks basis, including fine art, general and bank related specie, jewelers' block and armored car. The inland marine and ocean cargo team writes business covering builders' construction risk, contractors' equipment, transportation and ocean cargo risks in addition to exhibition, fine arts and museums insurance.

The aviation team writes physical damage insurance on hulls and spares (including war and associated perils) and comprehensive legal liability for airlines, smaller operators of airline equipment, airports and associated business and non-critical component part manufacturers. It also provides aviation hull deductible cover. Its financial and professional lines comprise financial institut! ions, pro! fessional liability (including management and technology liability), financial and political risks and the United States surety risks, written on a primary, qu ota share and facultative basis. Its financial institutions ! business ! is written on both a primary and excess of loss basis and consists of professional liability, crime insurance and directors' and officers' (D&O) cover. It covers financial institutions, including commercial and investment banks, asset managers, insurance companies, stockbrokers and insureds with hybrid business models. Its professional liability business is written out of the United States (including Errors and Omissions (E&O)), the United Kingdom and Switzerland and is written on both a primary and excess of loss basis.

The Company insures a range of professions, including lawyers, accountants, architects and engineers. Its management and technology liability teams write on both a primary and excess basis D&O insurance, technology-related policies in the areas of network privacy, misuse of data and cyber liability and warranty and indemnity insurance in connection with, or to facilitate, corporate transactions. The financial and political risks team writes business covering the credit/default risk on a range of project and trade transactions, as well as political risks, terrorism (including multi-year war on land cover), piracy and kidnap and ransom (K&R). It writes financial and political risks globally but with concentrations in a range of countries, such as Russia, China, Brazil, the Netherlands and United States. Its surety team writes commercial surety risks, admiralty bonds and similar maritime undertakings, including federal and public official bonds, license and permits and fiduciary and miscellaneous bonds and privately owned companies in the United States.

Advisors' Opinion:- [By Anna Prior]

Aspen Insurance Holdings Ltd.(AHL) said it expects second-quarter operating earnings above Wall Street projections, citing! “t! he continued excellent performance across our businesses.”

- [By Jake L'Ecuyer]

Equities Trading UP

Aspen Insurance Holdings (NYSE: AHL) shares shot up 11.05 percent to $43.72 after Endurance Specialty Holdings (NYSE: ENH) offered to buy Aspen Insurance for $47.50 per share in a cash and stock deal.

source from Top Stocks For 2015:http://www.topstocksblog.com/10-best-insurance-stocks-to-invest-in-right-now-3.html

Thursday, May 28, 2015

Hot High Tech Companies To Watch In Right Now

LONDON -- There are things to love and loathe about most companies. Today, I'm going to tell you about three things to love about�SSE� (LSE: SSE ) , formerly known as Scottish & Southern Energy

I'll also be asking whether these positive factors make this FTSE 100 utilities group a good investment today.

Dividends No. 1

SSE has delivered annual dividend growth for 13 successive years. Last year's payout of 80.1 pence was more than three times the first full-year dividend the company paid in 1999.

SSE's record is such that the company is now one of just five FTSE 100 members to have delivered better-than-inflation dividend growth every year during the period. The compound annual growth rate comes in at more than 9%.

Dividends No. 2

Not only is SSE's past dividend growth impressive, but�future�dividend growth also looks bright. According to SSE's chairman:

There can be every confidence that SSE will extend further its record of annual above-inflation dividend growth, and it is targeting a full-year increase of at least 2% more than RPI inflation, to around 84p, for 2012/13 and annual increases that are above RPI inflation in the following years.

Top 10 Forestry Stocks To Watch Right Now: Roma Financial Corporation(ROMA)

Roma Financial Corporation operates as a holding company for Roma Bank and RomAsia Bank that provide traditional retail banking services primarily in New Jersey. The company offers current deposit products, including checking and savings accounts, money market, certificates of deposit accounts, and individual retirement accounts. It also provides one-to four-family residential mortgage loans; multi-family and commercial mortgage loans; construction loans; commercial business loans; and consumer loans comprising home equity loans and lines of credit. In addition, the company sells title insurance; performs title searches; and provides real estate settlement and closing services. It operates 23 branch offices in Mercer, Burlington, Camden, and Ocean Counties, New Jersey; and 2 branches in Monmouth Junction and Edison, New Jersey. The company was founded in 1920 and is headquartered in Robbinsville, New Jersey.

Advisors' Opinion:- [By Tim Melvin]

He also pointed out that the approaching completion of Roma Financial (ROMA) and Investors Bancorp (ISBC) has some interesting implications for bank stock investors. Both are mutual holding companies, and the newly formed bank is expected to complete the process and do a second-step conversion offering. That will be a fairly large deal, much larger than most second-step offerings, as the combined banks should be somewhere around $3 billion in market cap. There will be larger investment banks involved, complete with road shows and institutional meetings to promote the deal. The attention could well cause a revaluation of the mutual holding company and converted thrift sector of the banking market.

Hot High Tech Companies To Watch In Right Now: St. Joe Co (JOE)

The St. Joe Company, incorporated on May 26, 1936, owns land, timber and resort assets located primarily in Northwest Florida, Jacksonville, Florida and Tallahassee, Florida. The Company operates in five segments: residential real estate, commercial real estate, resorts, leisure and leasing operations, forestry, and rural land. Its residential real estate segment plans and develops mixed-use resort, primary and seasonal residential communities of various sizes, primarily on the Company's existing land. In the Company's commercial real estate segment the Company plans, develops, manages and sells real estate for commercial purposes. Its leisure and leasing operations includes the Company's resorts and clubs financial information, which was presented in the residential real estate segment. The Company owns and operates forestry operations in the Southeastern United States. It traditionally sells parcels of varying sizes ranging from less than one acre to thousands of acres.

Residential Real Estate

The Company owns large tracts of land in Northwest Florida, including Gulf of Mexico beach frontage, and other waterfront properties and land in and around Jacksonville and Tallahassee. Within the Company's residential real estate business, the Company has two types of communities and is planning to add a third type. The first, the Company's residential resort communities, are positioned to attract primarily second home buyers. The Company's l projects in this category include the WaterColor and WaterSound Beach communities, which were built in a region of Florida. The Company's second category of residential communities is the Company's primary home communities for buyers who will use the community as their primary residence. The Breakfast Point, RiverTown and SouthWood communities are the Company's largest projects in this category. The Company's third category of residential communities is active adult communities.

Commercial Real Estate

The Company focuse! s on commercial development and sales in Northwest Florida because of its large land holdings surrounding the new Northwest Florida Beaches International Airport (the Airport), along roadways and near or within business districts in the region. The Company provides development opportunities for national and regional retailers and its strategic partners in Northwest Florida. The Company offers land for commercial and light industrial uses within large and small-scale commerce parks, as well as a range of multi-family rental projects. The Company also develops commercial parcels within or near existing residential development projects.

Resorts, Leisure and Leasing Operations

The Company's leasing operations were presented in both its residential real estate and commercial real estate segments. The Company's resorts, leisure and leasing operations segment includes recurring revenue streams from the Company's resort and leisure businesses and its leasing operations. The Company's WaterColor Inn and Resort is a boutique hotel, which provides guests with a beach club, spa, tennis center, restaurant and complementary retail and commercial space. The day-to-day operations of the WaterColor Inn and Resort is managed by Noble House Hotels & Resorts. In addition the Company's vacation rental business rents private homes in the WaterColor community and surrounding communities, primarily in those that the Company has built, to individuals who are vacationing in the area. The Company does not own the homes, but for a fee, the Company advertises , take reservations, check-in and check-out , and clean and maintains the home for the homeowner. The Company owns four golf courses in Northwest Florida. Three of them are in the Panama City Beach area and the fourth is located in Tallahassee. The golf courses are situated in or near the Company's residential communities. The Company also own two marinas. The Company's golf courses and marinas are managed for the Company by a third party management c! ompanies.!

The Company's leasing operations business includes the Company's retail and commercial leasing. The Company has several small retail shopping centers located in or near to some of its residential projects, such as the WaterColor, SouthWood and WindMark Beach communities that are managed by its leasing team. The Company's commercial leasing business includes industrial parks and several commerce parks. One of the industrial parks is the Company's VentureCrossings Enterprise Centre, a 1,000 acre commercial and industrial development adjacent to the Airport.

Forestry

The Company has 545,000 acres designated for forestry operations, including land in West Bay. Southern Pine, the Company's main product, is a product that fits well into cost-conscience supply chains. The Company's forestry operations can produce about 1.3 million tons of trees for lumber and pulp on an annual, sustainable basis. The Company rigorously examines the characteristics of individual trees in a forest and the interactions of those trees with each other and with the forest ecosystem as a whole in order to maximize the timber output. The Company produces both sawtimber (lumber used in construction) and pulp (timber used to make pulp for products like linerboard).

Rural Land

The majority of rural land sold is undeveloped timberland and is managed as timberland until sold, although some parcels include the benefits of limited development activity, including improved roads, ponds and fencing. The pricing of these parcels varies significantly based on size, location, terrain, timber quality and other local factors.

Advisors' Opinion:- [By Monica Wolfe]

St. Joe Corporation (JOE)

Bruce Berkowitz�� fourth largest holding is in St. Joe Corporation where he holds 6.8% of his total portfolio. As of the second quarter, the guru owned 25,017,933 shares of St. Joe, representing 27.10% of the company�� shares outstanding.

Hot High Tech Companies To Watch In Right Now: Brown & Brown Inc. (BRO)

Brown & Brown, Inc., a diversified insurance agency, engages in the marketing and sale of insurance products and services in the United States. Its Retail division provides insurance products and services to commercial, public and quasi-public entity, professional, and individual customers. This division offers property insurance relating to physical damage to property, and resultant interruption of business or extra expense caused by fire, windstorm, or other perils; casualty insurance relating to legal liabilities, workers� compensation, and commercial and private passenger automobile coverage; fidelity and surety bonds; group and individual life, accident, disability, health, hospitalization, medical, and dental insurance, as well as provides risk management and loss control surveys and analysis, and consultation services. The company�s National Programs division offers professional liability and related package insurance products for dentists, lawyers, accountants, o ptometrists, opticians, insurance agents, financial service representatives, benefit administrators, real estate brokers, real estate title agents, and escrow agents. This division also markets its products and services to specific industries, trade groups, public and quasi-public entities, and market niches through independent agents. The company�s Wholesale Brokerage division markets and sells excess and surplus commercial insurance products and services to retail insurance agencies; and reinsurance products and services to insurance companies. Its Services division offers insurance-related services, including third-party claims administration and comprehensive medical utilization management services for the workers� compensation and various liability arenas; medicare set-aside services; and social security disability and medicare benefits advocacy services. Brown & Brown, Inc. was founded in 1939 and is headquartered in Daytona Beach, Florida.

Advisors' Opinion:- [By Monica Gerson]

Brown & Brown (NYSE: BRO) is projected to post its Q3 earnings at $0.40 per share on revenue of $348.85 million.

Wintrust Financial (NASDAQ: WTFC) is expected to post its Q3 earnings at $0.64 per share on revenue of $195.50 million.

- [By Monica Gerson]

Brown & Brown (NYSE: BRO) is projected to post its Q3 earnings at $0.40 per share on revenue of $348.85 million. Brown & Brown shares rose 0.58% to close at $32.99 on Friday.

- [By Marc Bastow]

Diversified insurance company Brown & Brown (BRO) raised its quarterly dividend 11.1% to 10 cents per share, payable Nov. 13 to shareholders of record as of Oct. 30. This is the 20th consecutive annual increase in BRO’s dividend.

BRO Dividend Yield: 1.21%

Hot High Tech Companies To Watch In Right Now: CytRx Corporation(CYTR)

CytRx Corporation, a biopharmaceutical research and development company, engages in the development of human therapeutics, specializing in oncology. Its drug development pipeline includes INNO-206, which is in Phase II clinical trials for the treatment of soft tissue sarcomas and is in Phase Ib/2 clinical trials for the treatment of solid tumors; and tamibarotene that is in Phase II clinical trials for the treatment of non-small-cell lung cancer and acute promyelocytic leukemia. The company also develops Bafetinib, which is in Phase II clinical trials for the treatment of B-cell chronic lymphocytic leukemia and advanced prostate cancer, as well as in pharmacokinetic clinical trial for brain cancer. CytRx Corporation was founded in 1985 and is headquartered in Los Angeles, California.

Advisors' Opinion:- [By John Udovich]

On Wednesday, small cap biopharmaceutical stock CytRx Corporation (NASDAQ: CYTR) soared 68.2% after reporting positive results from a Phase 2B cancer drug trial, meaning its probably time to figure out what investors should do next plus take a look at the performance of biotech ETF benchmarks like the iShares NASDAQ Biotechnology Index ETF (NASDAQ: IBB) and SPDR S&P Biotech ETF (NYSEARCA: XBI).

- [By John Udovich]

Small cap biotech stock�CytRx Corporation (NASDAQ: CYTR) started the new year jumping 10.05% for an almost 50% rise over the past week or so after it surged 68.2% in one day in early�December, meaning it might be time to take a closer look at the stocks along with the performance of biotech ETF benchmarks like the�iShares NASDAQ Biotechnology Index ETF (NASDAQ: IBB) and SPDR S&P Biotech ETF (NYSEARCA: XBI). I should mention that we have recently added CytRx Corporation to our SmallCap Network Elite Opportunity (SCN EO) portfolio since December 20th and we are up around 49% since then.

Hot High Tech Companies To Watch In Right Now: CGI Group Inc (GIB)

CGI Group Inc. (CGI), incorporated on September 29, 1981, provides information technology (IT) consulting, systems integration, IT outsourcing and business solutions. The Company�� delivery model provides for work to be carried out onsite at client premises, or through its centers located globally. CGI has approximately 72,000 members across the globe. The Company also has a range of business solutions, which support long-term client relationships. Its services include consulting, systems integration, and management of information technology (IT) and business functions (outsourcing). On August 20, 2012, CGI completed its acquisition of Logica plc (Logica).

CGI has a range of business solutions, which include Momentum, CGI Advantage, CACS, CACS-G, Bureaulink and Strata. Momentum is an integrated enterprise resource planning suite in use by over 85 federal organizations across the three branches of the United States federal government, including 16 agencies. CGI�� enterprise resource planning solution, CGI Advantage, include financial management, payroll, budgeting, human resources management, procurement and grants management. The CGI Advantage client organizations include 22 states. CGI�� Credit Services Solutions include CACS, CACS-G and Bureaulink, Strata and other components.

Management of IT and Business Functions - Outsourcing

Clients delegate entire or partial responsibility for their IT or business functions to CGI. It implements its processes to improve the client�� operations. It also integrates clients��operations into its technology network. Services provided as part of an outsourcing contract may include development and integration of new projects and applications; applications maintenance and support; technology management (enterprise and end-user computing and network services); transaction and business processing, such as payroll, insurance processing and document management services. Outsourcing contracts have terms of up to 10 years.

Consulting and Systems Integration

CGI provides a full range of IT and business consulting services, including business transformation, IT strategic planning, business process engineering and systems architecture. CGI integrates and customizes technologies and software applications.

Advisors' Opinion:- [By Jonas Elmerraji]

Things are a little simpler in shares of CGI Group (GIB), an $11 billion Canadian IT services firm. You don't have to be an expert technical analyst to figure out what's going on in this stock. In fact, a quick glance at the chart will do.

That's because GIB is currently forming an uptrending channel. The pattern is just about as basic as it gets: a pair of parallel trendlines have been reigning in GIB's price action for all of 2013, bouncing shares higher all the way up. Those two price levels give traders a high-probability price range for shares of GIB, and as you might imagine, it makes sense to jump in close to trendline support.

Since GIB is currently in the middle of the price channel, it's still got a little downside room to push into before it becomes buyable. But shares are on their way down now, so it makes sense to keep this name on your radar. When the time comes to buy, keep a protective stopjust below the most recent swing low at $33.

- [By MONEYMORNING]

For instance, take a look at CGI Federal Inc., a subsidiary of Canadian IT solutions company CGI Group Inc. (NYSE: GIB).

CGI Federal is the largest recipient of Obamacare contract awards. The firm collected $149.9 million from April through the end of September - an impressive 35.5% of the total $421.8 million it has received since March 2010.�

- [By Keith Speights]

Blame game

Cheryl Campbell, a senior vice president with�CGI Group� (NYSE: GIB ) , the primary contractor for the federal Obamacare exchanges, blamed initial problems on another contractor. She stated that the system component that allowed users to create accounts caused bottlenecks that led to problems for users on the website.

Hot High Tech Companies To Watch In Right Now: Standard Motor Products Inc (SMP)

Standard Motor Products, Inc. (Standard Motor Products) is an independent manufacturer and distributor of replacement parts for motor vehicles in the automotive aftermarket industry, with a focus on the original equipment service market. The Company operates in two segments: Engine Management Segment and Temperature Control Segment. The Engine Management Segment manufactures ignition and emission parts, ignition wires, battery cables and fuel system parts. The Temperature Control Segment manufactures and remanufactures air conditioning compressors, air conditioning and heating parts, engine cooling system parts, power window accessories, and windshield washer system parts. In January 2014, the Company acquired the assets of Pensacola Fuel Injection, a privately-held company.

The Company�� customers consist of warehouse distributors, such as CARQUEST Corporation and NAPA Auto Parts, as well as auto parts retail chains, such as Advance Auto Parts, Inc., AutoZone, Inc., O��eilly Automotive, Inc., Canadian Tire Corporation and Pep Boys. Its customers also include national program distribution groups, such as Federated Auto Parts, Inc., All Pro/Bumper to Bumper (Aftermarket Auto Parts Alliance, Inc.), Automotive Distribution Network and The National Pronto Association, and specialty market distributors. The Company distributes parts under its own brand names, such as Standard, BWD, Intermotor, GP Sorensen, TechSmart, OEM, Four Seasons, Factory Air, EVERCO, ACi, Imperial and Hayden and through private labels, such as CARQUEST, O��eilly Import Direct and Master Pro, NAPA Echlin, NAPA Temp Products and NAPA Belden.

Engine Management Segment

The Company manufacture a line of engine management replacement parts including, electronic ignition control modules, fuel injectors, ignition wires, voltage regulators, coils, switches, emission sensors, EGR valves, distributor caps and rotors and other engine management components primarily under its brand names Standard, BWD! , Intermotor, OEM, TechSmart and GP Sorensen, and through private labels, such as CARQUEST, O��eilly Import Direct and Master Pro, NAPA Echlin and NAPA Belden. In its Engine Management Segment, replacement parts for ignition, emission control and fuel systems accounted for approximately 60% of the Company�� revenues during the year ended December 31, 2011.

Vehicles are factory-equipped with computer-controlled engine management systems to control ignition, emission and fuel injection systems. The on-board computers monitor inputs from many types of sensors located throughout the vehicle, and control a myriad of valves, injectors, switches and motors to manage engine and vehicle performance. Electronic ignition systems enable the engine to operate with improved fuel efficiency and reduced level of hazardous fumes in exhaust gases. Wire and cable parts accounted for approximately 12% of the Company�� revenues during 2011. These products include ignition (spark plug) wires, battery cables and a range of electrical wire, terminals, connectors and tools for servicing an automobile�� electrical system. The component of this product line is the sale of ignition wire sets.

Temperature Control Segment

The Company manufactures, remanufactures and markets a line of replacement parts for automotive temperature control (air conditioning (AC) and heating) systems, engine cooling systems, power window accessories and windshield washer systems, primarily under its brand names of Four Seasons, EVERCO, ACi, Hayden, Factory Air and Imperial, and through private labels, such as CARQUEST, NAPA Temp Products and Murray.

The product groups sold by its Temperature Control Segment are new and remanufactured compressors, clutch assemblies, blower and radiator fan motors, filter dryers, evaporators, accumulators, hose assemblies, expansion valves, heater valves, AC service tools and chemicals, fan assemblies, fan clutches, engine oil coolers, transmission coolers, wind! ow lift m! otors, motor/regulator assemblies and windshield washer pumps. The Company�� temperature control products accounted for approximately 27% of the Company�� revenues during 2011.''

The Company competes with ACDelco, Delphi Automotive PLC, Denso Corporation, Robert Bosch Corporation, Visteon Corporation, NGK/NTK, General Cable, Prestolite, United Components, Inc, ACDelco, Delphi Automotive PLC, Denso Corporation, Sanden International, Inc., Continental AG and Vista-Pro Automotive, LLC.

Advisors' Opinion:- [By Jeremy Bowman]

What: Shares of Standard Motor Products (NYSE: SMP ) weren't looking up to snuff today, falling as much as 10% today after Goldman Sachs downgraded the entire U.S. auto sector and lowered its rating on Standard form "neutral" to "sell."

- [By Seth Jayson]

Calling all cash flows

When you are trying to buy the market's best stocks, it's worth checking up on your companies' free cash flow once a quarter or so, to see whether it bears any relationship to the net income in the headlines. That's what we do with this series. Today, we're checking in on Standard Motor Products (NYSE: SMP ) , whose recent revenue and earnings are plotted below. - [By , Zacks Investment Research]

Standard Motor Products (SMP) makes�replacement parts for motor vehicles in the automotive aftermarket industry with an increasing focus on the original equipment service market. It has a market cap of $959 million.

5 Best Airline Stocks To Own Right Now

In an amazing year for the S&P 500, some stocks stood out for their incredible performance. Choose your own superlative when considering the gains in Netflix (NFLX), Micron Technology (MU), Best Buy (BBY), Delta Air Lines (DAL) and Pitney Bowes (PBI).

Getty ImagesAs has been highlighted by Alexandra Skaggs of the Wall Street Journal, stocks with cheap valuations outperformed this year, and that’s a group that includes Delta Air Lines, which has a P/E of just 10.5 for the coming year, while Best Buy comes in at 13.8 and Pitney Bowes at 13.1. Of course, Delta gained 131% by exceeding all expectations as the airline industry consolidated all around it, while Best Buy rose 236% by proving it wasn’t dead yet. Pitney Bowes rose nearly 120% after transforming itself from a dying stamp company into a software provider.

Hot Consumer Service Companies To Watch For 2016: Singapore Airlines Ltd (SINGY)

Singapore Airlines Limited is a passenger air transportation company. The Company, together with its subsidiaries, is engaged in passenger and cargo air transportation, engineering services, training of pilots, air charters and tour wholesaling and related activities. The Company consists of 101 aircrafts. The Company operates in four segments: airline operations, cargo operations, engineering services and others. The Company's subsidiaries are SIA Engineering Company Limited (SIAEC), SIA Cargo and SilkAir (Singapore) Private Limited (SilkAir). Effective December 24, 2013, Singapore Airlines Ltd, a unit of Temasek Holdings (Pte) Ltd, raised its interest to 40.004% from 32.67% by acquiring a 7.334% interest in Tiger Airways Holdings Ltd from Dahlia Investments Ptye Ltd and Aranda Investments Pte Ltd. Advisors' Opinion:- [By Bruce Kennedy]

Business travel columnist Joe Brancatelli reports the world's longest non-stop commercial route, the Singapore Airlines (OTC: SINGY) 18-hour, business class-only flight between Newark, N.J. and Singapore, will end on Saturday. The airline also retired the world's second-longest non-stop flight, Los Angeles-to-Singapore, last month.

5 Best Airline Stocks To Own Right Now: WestJet Airlines Ltd (WJA)

WestJet Airlines Ltd. (WestJet) provides airline service and travel packages with scheduled service to more than 85 destinations in North America, Central America and the Caribbean, and has partnership agreements with over 30 airlines around the world. WestJet operates a fleet of more than 100 Boeing Next-Generation 737 and Bombardier Q400 NextGen aircraft. The Company�� subsidiaries include WestJet Investment Corp., WestJet Operations Corp., WestJet Vacations Inc. and WestJet Encore Ltd. Advisors' Opinion:- [By Gerrit De Vynck]

Closely held Porter unveiled plans in April to add as many as 30 CSeries jets in an order valued at as much as $2.1 billion from Montreal-based Bombardier to reach as far as Los Angeles and the Caribbean as it challenges the country�� two biggest carriers, Air Canada and WestJet Airlines Ltd. (WJA) The order, which would be Bombardier�� first for the aircraft with a Canadian carrier, is conditional on the runway extension and a removal of the jet ban.

- [By Eric Lam]

BlackBerry, the smartphone maker looking to sell itself, lost 3.6 percent to pace declines among technology stocks. WestJet (WJA) Airlines Ltd. dropped 2.5 percent as load factor slipped in September. Valeant Pharmaceuticals International Inc. rose 1.4 percent after receiving approvals for products in the U.S. and Canada. Agrium Inc. added 0.7 percent after naming a successor for its retiring chief executive officer.

5 Best Airline Stocks To Own Right Now: American Airlines Group Inc (AAL)

American Airlines Group Inc., formerly AMR Corporation, incorporated in October 1982, operates in the airline industry. The Company's principal subsidiary is American Airlines, Inc. (American). As of December 31, 2011, American provided scheduled jet service to approximately 160 destinations throughout North America, the Caribbean, Latin America, Europe and Asia. AMR Eagle Holding Corporation (AMR Eagle), a wholly owned subsidiary of the Company, owns two regional airlines, which do business as American Eagle-American Eagle Airlines, Inc. and Executive Airlines, Inc. (collectively, the American Eagle carriers). American also contracts with an independently owned regional airline, which does business as AmericanConnection (the AmericanConnection carrier). As of December 31, 2011, AMR Eagle operated approximately 1,500 daily departures, offering scheduled passenger service to over 175 destinations in North America, Mexico and the Caribbean.

American, AMR Eagle and the AmericanConnection airline served more than 250 cities in approximately 50 countries with, on average, 3,400 daily flights and the combined network fleet numbered approximately 900 aircraft as of December 31, 2011. American Airlines is also a founding member of the oneworld alliance, which includes British Airways, Cathay Pacific, Finnair, LAN Airlines, Iberia, Qantas, JAL, Malev Hungarian, Mexicana, Royal Jordanian and S7 Airlines. Together, oneworld members serve 750 destinations in approximately 150 countries, with about 8,500 daily departures. American is also one of the scheduled air freight carriers in the world, providing a range of freight and mail services to shippers throughout its system onboard American's passenger fleet.

To improve access to each other's markets, American has established marketing relationships with other airlines and rail companies. As of December 31, 2011, American had marketing relationships with Air Berlin, Air Pacific, Air Tahiti Nui, Alaska Airlines, British Airways, Cape Air, C! athay Pacific, China Eastern Airlines, Dragonair, Deutsche Bahn German Rail, EL AL, Etihad Airways, EVA Air, Finnair, GOL, Gulf Air, Hawaiian Airlines, Iberia, Japan Airlines (JAL), Jet Airways, JetStar Airways, LAN (includes LAN Airlines, LAN Argentina, LAN Ecuador and LAN Peru), Niki Airlines, Qantas Airways, Royal Jordanian, S7 Airlines, and Vietnam Airlines.

American has established the AAdvantage frequent flyer program (AAdvantage). AAdvantage members earn mileage credits by flying on American, American Eagle and the AmericanConnection carrier or by using services of other participants in the AAdvantage program. Mileage credits can be redeemed for free, discounted or upgraded travel on American, American Eagle or other participating airlines, or for other awards. American sells mileage credits and related services to other participants in the AAdvantage program. There are over 1,000 program participants, including a credit card issuer, hotels, car rental companies, and other products and services companies in the AAdvantage program. As of December 31, 2011, AAdvantage had approximately 69 million total members.

The Company competes with Alaska Airlines (Alaska), Delta Air Lines (Delta), Frontier Airlines, JetBlue Airways (JetBlue), Hawaiian Airlines, Southwest Airlines (Southwest) and AirTran Airways (Air Tran), Spirit Airlines, United Airlines (United) and Continental Airlines (Continental), US Airways and Virgin America Airlines.

Advisors' Opinion:- [By Adam Levine-Weinberg]

Pilot recruitment has become a huge problem for regional airlines due to low starting wages and new rules that require 1,500 hours of flight time for co-pilots. In February, Republic Airways removed 27 small regional jets from service this year to free up pilot labor for 25 new 76-seat jets that it will fly for American Airlines (NASDAQ: AAL ) .

- [By Susan J. Aluise]

The carrier won big when it picked up the lion�� share of the slots the new American Airlines (AAL) had to divest at Washington D.C.�� Regan airport. However, LUV is facing headwinds from its strategy shift to international, as well as growing pains from its AirTran integration this year.

- [By Matt Egan]

Airline stocks, which have been big winners this year, descended as traders worry about potential travel repercussions. American Airlines (AAL), Delta Air Lines (DAL), JetBlue (JBLU) and Southwest (LUV) all dropped more than 3%. Cruise operators Carnival (CCL) and Royal Caribbean (RCL) also lost ground.

- [By Mathew Schwartz]

AP/Susan Walsh • The new CEO of post-merger American Airlines (AAL), Doug Parker, made two statements on CNBC Monday that we really, really want to believe. One: In spite of the merger, airfares won't rise "as long as demand stays the same." And two: Now that all of the majors can pretty much fly you anywhere, they are going to have to compete on service. We're trying to imagine a world in which airlines are serious about wooing ordinary travelers with a better flying experience. • Speaking of air travel, check this out. For sale: One large international airport in a scenic Spanish location -- a steal at just 10 percent of the $1.4 billion it cost to build. It's been unused for a few years, because, turns out, that whole "if you build it, they will come" theory doesn't always apply to new airports in nations experiencing massive real estate bubbles. Yes, you'll have to lay out $140 million, but come on: You can land an Airbus 380 there. What better way to become the envy of all your friends who are tooling around in little Gulfstreams or () Netjets? • The Washington Post has done a fascinating analysis of inequality in America, and how the income and educational "elite" have sorted themselves geographically away from the hoi polloi, and what that means for society at large. It's well worth a read (and you know you're curious about where your ZIP code falls on the spectrum.) Also, for a quick look, here are the top 20 elite ZIP codes. • GM (GM) is officially Government Motors no more, now that the Treasury has sold the last of its stock in the automaker, accepting a $10.7 billion loss on the direct investment. On the up side, it also saved 1.5 million American jobs (keeping those folks off the dole) and preserved $105.3 billion in tax revenues. But forget all that. That's the old General Motors news. The new news is that GM has picked its first woman CEO: Mary Barra, who now holds what many consider the most important job in the compa

5 Best Airline Stocks To Own Right Now: Qantas Airways Ltd (QUBSF)

Qantas Airways Limited is engaged in the operation of international and domestic air transportation services, the provision of freight services and the operation of a Frequent Flyer loyalty program. The Company�� main business is the transportation of customers using two complementary airline brands: Qantas and Jetstar. It also operates subsidiary businesses, including other airlines, and businesses in specialist markets, such as Q Catering. The Company operates in four segments: Qantas Domestic, Qantas International, Qantas Loyalty and Qantas Freight. Qantas Domestic includes Australian domestic passenger flying business of Qantas Brands. Qantas International includes the International passenger flying business of Qantas Brands. Qantas Loyalty Operates the Qantas customer loyalty program. In April 2014, Qantas Airways Ltd announced that Westpac Banking Corporation and its associated companies ceased to be a substantial share holder of the Company. Advisors' Opinion:- [By MARKETWATCH]

LOS ANGELES (MarketWatch) -- Australian stocks rose in early Monday trading, helped by Wall Street's gains Friday, with the S&P/ASX 200 (AU:XJO) climbing 0.8% to 5,362.40 after closing the previous session at its highest level since before the start of the 2008 financial crisis. Miners were broadly improving, as Fortescue Metals Group Ltd. (AU:FMG) (FSUMF) rose 1.3%, BHP Billiton Ltd. (AU:BHP) (BHP) added 0.9% ahead of its quarterly production report Tuesday, and Newcrest Mining Ltd. (AU:NCM) (NCMGF) also climbed 0.9% despite a loss for gold at the end of last week. Financials saw gains as well, with many analysts now tipping the U.S. Federal Reserve to maintain its current level of easing through the end of the year. Australia & New Zealand Banking Group (AU:ANZ) (ANEWF) advanced 1.1%, while Westpac Banking Corp. (AU:WBC) (WEBNF) and Macquarie Group Ltd. (AU:MQG) (MCQEF) rose 1.2% each. On the downside, shares of Qantas Airways Ltd. (AU:QAN) (QUBSF) fell 4.2% after the company warned of rough business conditions on Friday.

Wednesday, May 27, 2015

Top Rising Stocks To Own For 2016

Top Rising Stocks To Own For 2016: Intercept Minerals Ltd (UMG)

Intercept Minerals Ltd. is engaged in gold and base metals exploration. The Company focuses on Ianna Gold Project in Guyana South America. The Ianna Joint Venture encompassed mineral rights over a 54 square kilometer suite of contiguous mining permits, which are centred over the Ianna/Yakishuru gold mining district located within the well-known Guiana shield region of Guyana. The Box Hole lead/zinc project is located in the Northern Territory, Australia. The Adnera project (alaskite hosted) is located approximately 200 kilometer north of Alice Springs in the Northern Territory. The Millionaires Well Tungsten project is located about 200 kilometer north of Alice Springs. The bauxite project is located in the north east region of Melville Island within the Tiwi Islands north of Darwin. Advisors' Opinion:- [By Vera Yuan]

Vivendi SA (0.4%) (VIV) (VIV - $24.47 - NYSE) is a French media and telecommunications holding company in the late stages of a decade long transition. In April 2014, the company announced it had reached an agreement to sell its French wireless operation, SFR, to French cable operator Numericable. Over the last year, the company also sold most of its 62% stake in Activision Blizzard and reached an agreement to sell its entire 53% stake in Maroc Telecom SA. After closing the SFR sale in early 2015, Vivendi will be a more focused media firm, consisting of Canal+ (a Francophone focused pay television network owner and distributor), Universal Music Group (UMG), the number one recording music company and number two music publishing entity in the world, and GVT, a fast growing Brazilian broadband and pay television provider. We expect GVT to eventually be sold and would not dismiss the possibility of a breakup of Canal+ and UMG. While operating conditions have been challenging i n most of Vivendi's businesses, it a! ppears their trajectory is finally turning more positive and should be supported by a healthier balance sheet after the SFR, Activision and Maroc disposals.From Mario Gabelli (Trades, Portfolio)'s The Gabelli Asset Fund Second Quarter 2014 Shareholder Commentary.Also check out: Mario Gabelli Undervalued Stocks Mario Gabelli Top Growth Companies Mario Gabelli High Yield stocks, and Stocks that Mario Gabelli keeps buying Currently 0.00/512345

Rating: 0.0/5 (0 votes)

- [By WWW.GURUFOCUS.COM]

Vivendi SA (0.5%) (XPAR:VIV)(VIV - €20.22 - EPA) is a French media and telecommunications holding company in the late stages of a decade long transition. In April 2014, the company announced it had reached an agreement to sell its French wireless operation, SFR, to French cable operator Numericable. Over the last year the company also sold most of its 62% stake in ActivisionBlizzard and reached an agreement to sell its entire 53% stake in Maroc Telecom SA. After closing the SFR sale in early 2015, Vivendi will be a more focused media firm consisting of Canal+ (a Francophone focused pay television network owner and distributor), Universal Music Group (UMG) (the number one recording music company and number two music publishing entity in the world) and GVT (a fast growing Brazilian broadband and pay television provider). We expect GVT to eventually be sold and would not dismiss the possibility of a breakup of Canal+ and UMG. While operating conditions have been challengin g in most of Vivendi's businesses, it appears their trajectory is finally turning more positive and should be supported by a healthier balance sheet after the SFR, Activision and Maroc disposals.From Mario Gabelli (Trades, Portfolio)'s Gabelli Asset Fund's first quarter 2014 shareholder commentary.Also check out: Mario Gabelli Undervalued Stocks Mario Gabelli Top Growth Companies Mario Gabelli High Yield stocks, and Stocks that Mario Gabelli keeps buying Currently 5.00/512345

Rating: 5.0/5 (1 vote)

sou! rce from Top Stocks For 2015:http://www.topstocksblog.com/top-rising-stocks-to-own-for-2016.html

Tuesday, May 26, 2015

Top 10 Small Cap Stocks To Watch Right Now

Top 10 Small Cap Stocks To Watch Right Now: China Metro-Rural Holdings Limited(CNR)

China Metro-Rural Holdings Limited, through its subsidiaries, primarily engages in the development and operation of agricultural logistics and trade centers in northeast China. It also involves in purchasing, processing, assembling, merchandising, and distributing pearls and jewelry products. The company markets its pearls and jewelry products to wholesale distributors and mass merchandisers in Europe, the United States, Hong Kong, and other parts of Asia. In addition, it develops, sells, and leases residential and commercial properties in Hong Kong and the People?s Republic of China. The company is based in Tsimshatsui, Hong Kong.

Advisors' Opinion:- [By Katie Brennan]

Canadian National Railway Co. (CNR) added 0.9 percent to C$104.93 and Canadian Pacific Railway Ltd. rose 1.7 percent to C$131.73.

Niko Resources surged 3.4 percent to $8.64 after the company entered an agreement for a $60 million loan that will be funded by a group of institutional investors. Net proceeds from the loan will be used to fund working capital requirements.

source from Top Penny Stocks For 2015:http://www.seekpennystocks.com/top-10-small-cap-stocks-to-watch-right-now-3.html

Monday, May 25, 2015

Best Insurance Stocks For 2015

Saturday, May 4 is the date for the 2013�Berkshire Hathaway� (NYSE: BRK-A ) (NYSE: BRK-B ) �meeting. But what exactly does that mean?

To some extent, Berkshire's annual meeting is just like any other company's annual meeting. That is to say, it's a chance for management to meet with shareholders and update them on how well (or poorly) the company is doing. However, that's pretty much where the similarities end.

The Berkshire annual meeting is a dash of "true" annual meeting along with heavy helpings of value-investing rally, diversified consumer products convention, media circus, and all-out wild extravaganza.�

The day starts�very�early with jockeying for position as tens of thousands of Berkshire shareholders converge on the CenturyLink Center in Omaha. At 7 a.m., those early rising Berkshire faithful are able to enter the convention hall and browse stands from a wide variety of Berkshire-owned companies -- from See's Candies to Justin Boots and Brooks running shoes. You can even buy some GEICO insurance or participate in the second annual International Newspaper Tossing Challenge, where Buffett takes on all comers.

Hot Companies To Watch In Right Now: Tryg A/S (TRYG)

Tryg A/S, formerly TrygVesta A/S, is a Denmark-based insurance company. It is the parent company within the Tryg Group, which supplies insurance services in the Nordic countries. The Company is organized in four business areas, namely Private, Commercial, Industry and Sweden. Private sells insurance products to private individuals in Denmark and Norway. Commercial sells insurance products to small and medium-sized companies in Denmark and Norway. Industry sells insurance products to industrial customers under the Tryg brand in Denmark and Norway and the Moderna brand in Sweden. Sweden sells insurance products to private individuals in Sweden under the Moderna brand name. As of December 31, 2012, the Company had one wholly owned subsidiary, Tryg Forsikring A/S. On May 1, 2013, it sold its Finnish branch. Advisors' Opinion:- [By Sofia Horta e Costa]

Commodity producers slid as the release fueled concern about the slowdown in the world�� second-biggest economy. Burberry Group Plc (BRBY) gained 4.8 percent after the company�� spring-summer collection helped increase retail sales in its fiscal first quarter by more than analysts had estimated. Tryg A/S (TRYG) added 3.3 percent after posting better-than-forecast pretax profit as cost cuts offset increased weather-related claims.

Best Insurance Stocks For 2015: Euler Hermes SA (ELE)

Euler Hermes SA is a France-based credit insurance company. It offers a range of services, including loan assurance, risk assessment, trade debt collection, compensation of losses due to buyer insolvency, bonding and guarantees for companies, reinsurance of loans to individuals and fidelity insurance covering companies against financial loss caused by fraudulent acts. It operates a number of subsidiaries, including Euler Hermes SFAC, Euler Hermes ACI Holding Inc., Euler Hermes Reinsurance AG, among others. On January 1, 2012, the Company completed the simplification of its legal structure in Europe by grouping 13 of its former subsidiaries into one insurance company, Euler Hermes Europe, located in Brussels. Advisors' Opinion:- [By Sarah Jones]

Iberdrola SA (IBE), Spain�� biggest power company, fell 3.4 percent to 3.87 euros. Endesa SA (ELE) slumped 4.6 percent to 16 euros, while Acciona SA (ANA), which owns more than 4 gigawatts of wind farms in the country, tumbled 8.5 percent to 37.95 euros. Red Electrica Corp. slid 7.5 percent to 38.34 euros.

Best Insurance Stocks For 2015: W.R. Berkley Corporation(WRB)

W. R. Berkley Corporation, an insurance holding company, operates as commercial lines writers in the property casualty insurance business primarily in the United States. The company operates in five segments: Specialty, Regional, Alternative Markets, Reinsurance, and International. The Specialty segment underwrites third-party liability risks, primarily excess, and surplus lines, including premises operations, professional liability, commercial automobile, products liability, and property lines. The Regional segments provide commercial insurance products to small-to-mid-sized businesses, and state and local governmental entities primarily in the 45 states of the United States. The Alternative Markets segment develops, insures, reinsures, and administers self-insurance programs and other alternative risk transfer mechanisms. This segment offers its services to employers, employer groups, insurers, and alternative market funds, as well as provides a range of fee-based servic es, including consulting and administrative services. The Reinsurance segment engages in the underwriting property casualty reinsurance on a treaty and a facultative basis, including individual certificates and program facultative business; and specialty and standard reinsurance lines, and property and casualty reinsurance. The International segment offers personal and commercial property casualty insurance in South America; commercial property casualty insurance in the United Kingdom and continental Europe; and reinsurance in Australia, Southeast Asia, and Canada. The company was founded in 1967 and is based in Greenwich, Connecticut.

Advisors' Opinion:- [By Laura Brodbeck]

Earnings reports expected on Monday include:

Netflix, Inc. (NASDAQ: NFLX) is expected to report third quarter EPS of $0.48 on revenue of $1.10 billion, compared to last year�� EPS of $0.13 on revenue of $905.09 million. Discover Financial Services (NYSE: DFS) is expected to report third quarter EPS of $1.19 on revenue of $2.07 billion, compared to last year�� EPS of $1.21. W.R. Berkley Corporation (NYSE: WRB) is expected to report third quarter EPS of $0.71 on revenue of $1.57 billion, compared to last year�� EPS of $0.61 on revenue of $1.42 billion. Gannett Co., Inc. (NYSE: GCI) is expected to report third quarter EPS of $0.44 on revenue of $1.27 billion, compared to last year�� EPS of $0.56 on revenue of $1.31 billion.Economics

- [By Monica Gerson]

W.R. Berkley (NYSE: WRB)is estimated to report its Q3 earnings at $0.74 per share on revenue of $1.57 billion.

V.F. Corp (NYSE: VFC) is projected to report its Q3 earnings at $3.78 per share on revenue of $3.34 billion.

- [By Ben Levisohn]

For the past several years, Berkshire has contrasted its own cost-free float provided by profitable underwriting against the industry�� (unimpressive) tendency to lose money on underwriting while generating net returns from investment income. So far, so good. Less edifying, though, is the repeated contrast of Berkshire�� track record of profitability to State Farm��…even though, as a mutual company, State Farm�� profitability goals are inherently different from for-profit insurers like Berkshire. It�� true that through year-end 2013, Berkshire�� underwriters have ��ow operated at an underwriting profit for eleven consecutive years,��but so have ACE (ACE), American Financial (AFG),� AmTrust Financial (AFSI), Arch Capital (ACGL), Chubb (CB), HCC (HCC), Progressive (PGR), RLI (RLI), and W.R. Berkley (WRB), any or all of whom provide a more meaningful comparison than contrasting Berkshire�� results to a company that�� not out to produce a profit in the first place.

Best Insurance Stocks For 2015: Aviva PLC (AVV)

Aviva plc (Aviva) is an insurance group engaged in provision of products and services, such as long-term insurance and savings, fund management and general insurance. Aviva provides long-term insurance and savings, general and health insurance, and fund management products and services. Its business is managed on four geographic regions: United Kingdom, Europe, North America and Asia Pacific. The four regions, together with Aviva Investors, function as six operating segments. The UK region is split into the UK Life and UK General Insurance segments, which undertake long-term insurance and savings business and general insurance, respectively. In April 2013, it transferred its holding in Spanish joint venture Aseval to Bankia. In October 2013, Aviva sold Aviva USA Corporation to Athene Holding Ltd. Effective December 12, 2013, Redefine International Plc, a unit of Redefine Properties Ltd, acquired Weston Favell Shopping Centre from Aviva Commercial Finance Ltd, a unit of Aviva plc. Advisors' Opinion:- [By Namitha Jagadeesh]

Kabel Deutschland Holding AG rose to a record after getting an offer from Liberty Global Plc. Aveva Group Plc (AVV) jumped 5.4 percent as Citigroup Inc. upgraded the shares. Danske Bank A/S (DANSKE) dropped 6.1 percent after Denmark�� financial regulator ordered it to increase its risk-weighted assets. Royal Imtech NV fell to the lowest price since 2004 after posting a first-quarter loss on costs relating to a fraud investigation.

Best Insurance Stocks For 2015: ING Groep NV (ING)

ING Groep N.V. (ING), incorporated in 1991, is a global financial institution offering banking, investments, life insurance and retirement services to meet the needs of the customers. The Company�� segments include banking and insurance. Banking segment includes retail Netherlands, retail Belgium, ING direct, retail central Europe (CE), retail Asia, commercial banking (excluding real estate), ING real estate and corporate line banking. Insurance segment includes insurance Benelux, insurance central and rest of Europe (CRE), insurance United States (US), Insurance US closed block VA, insurance Asia/Pacific, ING investment management (IM) and corporate line insurance. In February 2011, the Company divested its real estate investment operation ING Real Estate Investment Management (ING REIM) to CB Richard Ellis Group Inc. In June 2011, the Company sold Clarion Partners. In July 2011, ING announced the completion of the sale of Clarion Real Estate Securities. During the year ended December 31, 2011, the Company divested its interests in ING Car Lease and ING IM Philippines. In February 2012, Capital One Financial Corp. acquired ING Direct business in the United States from the Company.

In June 2011, ING had completed the sale of its interest in China�� Pacific Antai Life Insurance Company Ltd. In June 2011, ING announced the completion of the sale of real estate investment manager of its United States operations, Clarion Partners, to Clarion Partners management in partnership with Lightyear Capital LLC. In October 2011, ING announced that it had completed the sale of REIM�� Asian and European operations to CBRE Group Inc. In December 2011 ING completed the sale of its Latin American pensions, life insurance and investment management operations.

Retail Netherlands

Retail Banking reaches its individual customers through Internet banking, telephone, call centers, mailings and branches. Using direct marketing methods, it is a provider of current account services an! d payments systems to provide other financial services, such as savings accounts, mortgage loans, consumer loans, credit card services, investment and insurance products. Mortgages are offered through a tied agents sale force and direct and intermediary channels. ING Bank Netherlands operates through a branch network of approximately 280 branches. It offers a range of commercial banking activities and also life and non-life insurance products. It also sells mortgages through the intermediary channel.

Retail Belgium

ING Belgium provides banking, insurance (life, non-life) and asset management products and services to meet the needs of individuals, families, companies and institutions through a network of local head offices, 773 branches and direct banking channels (automated branches, home banking services and call centers). ING Belgium also operates a second network, Record Bank, which provides a range of banking products through independent banking agents and credit products through a multitude of channels (agents, brokers, vendors).

ING Direct